Free 5080 Michigan Template in PDF

The 5080 Michigan form is a crucial document for businesses operating in the state, designed to streamline the reporting of sales, use, and withholding taxes. This form is issued by the Michigan Department of Treasury and serves as a monthly or quarterly return, depending on the taxpayer's filing frequency. It encompasses several key components that help businesses accurately report their tax obligations. In the first section, taxpayers must detail their gross sales, including rentals and services, while calculating the total sales and use tax owed at a rate of 6%. Additionally, the form allows for the reporting of pre-paid taxes and provides a mechanism for claiming allowable discounts based on timely payments. The second section addresses use tax on items purchased for business or personal use, ensuring that all taxable purchases are accounted for. The third section focuses on withholding tax, where businesses must report the total Michigan income tax withheld during the reporting period. Finally, the form concludes with a summary of the total tax payment due, which consolidates all tax types and any applicable penalties or interest for late filing. Understanding the 5080 form is essential for compliance and can help avoid potential penalties, making it a vital tool for any Michigan business owner.

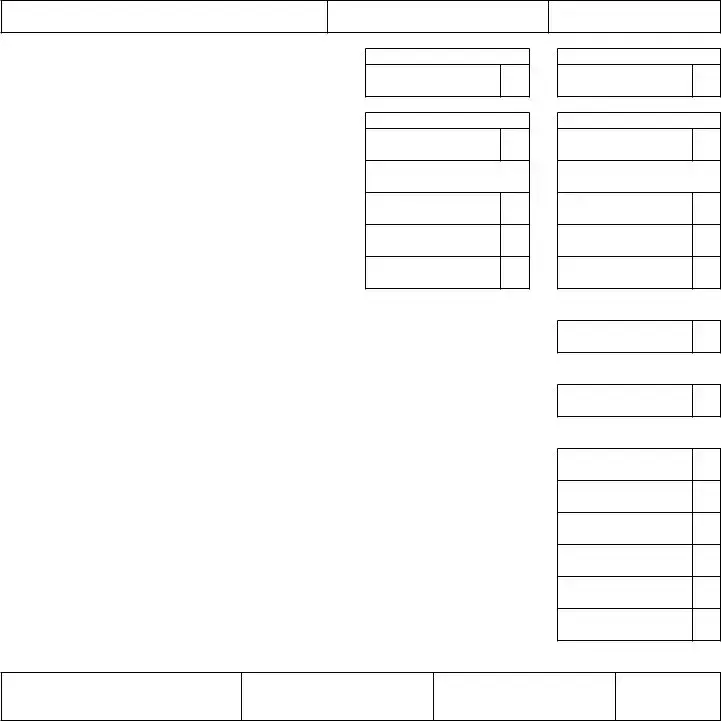

Form Example

Michigan Department of Treasury 5080

2015 Sales, Use and Withholding Taxes Monthly/Quarterly Return

Issued under authority of Public Acts 167 of 1933 and 94 of 1937, as amended.

This form cannot be used as an amended return; see the Amended Monthly/Quarterly Return (Form 5092).

Taxpayer’s Business Name

Business Account Number (FEIN or TR Number)

Return Period Ending

PaRT 1: SaleS and USe Tax

1. Gross sales, rentals and services |

1a. |

Sales

1b.

Use: Sales and Rentals

2.Total sales and/or use tax. Multiply taxable sales,

rentals and services by 6% (0.06) .................................................

3.Total

4.Remaining amount of sales and use tax eligible for discount. Subtract line 3 from line 2..............................................................

5.Total of allowable discounts. Multiply line 4 by your applicable discount rate..................................................................................

2a.

3a.

4a.

5a.

a. Sales Tax

XXXXXXX

2b.

3b.

4b.

5b.

B. Use Tax

XXXXXXX

6. Total sales and use tax due. Subtract line 5 from line 4 |

6a. |

6b.

PaRT 2: USe Tax on ITeMS PURchaSed foR BUSIneSS oR PeRSonal USe

7. Total amount of use tax from purchases and withdrawals from inventory. |

|

Multiply taxable amount by 6% (0.06) |

7. |

PaRT 3: WIThholdIng Tax

8. Total amount of Michigan income tax withheld |

8. |

PaRT 4: ToTal Tax/PayMenT dUe

9. |

Amount of sales, use and withholding tax due. Add lines 6a, 6b, 7, and 8. If amount is negative, this is the |

|

|

amount available for future tax periods (skip lines |

9. |

10. |

Overpayment from prior return period or amount previously paid for this return period |

10. |

11. |

Amount of tax due. Subtract line 10 from line 9 |

11. |

12. |

Penalty paid with this return (for late iling) |

12. |

13. |

Interest paid with this return (for late iling) |

13. |

14. |

PayMenT dUe. Add lines 11, 12 and 13 |

14. |

Taxpayer Certiication. I declare under penalty of perjury that this return is true and complete to the best of my knowledge.

Signature of Taxpayer or Oficial Representative (must be Owner, Oficer, Member, Manager, or Partner)

Printed Name

Title

Date

Make check payable to “State of Michigan” and include your account number on your check.

Send your return and any payment due to: Michigan Department of Treasury, P.O. Box 30324, Lansing, MI

+ 0000 2015 66 01 27 1

Instructions for 2015 Sales, Use and Withholding Taxes Monthly/Quarterly Return (Form 5080)

IMPORTANT: This is a return for Sales Tax, Use Tax, and/ or Withholding Tax. If the taxpayer inserts a zero on (or leaves blank) any line for reporting Sales Tax, Use Tax, or Withholding Tax, the taxpayer is certifying that no tax is owed for that tax type. If it is determined that tax is owed, the taxpayer will be liable for the deficiency as well as penalty and interest.

PaRT 1: SaleS and USe Tax

Line 1a: Total gross sales for tax period being reported. Enter the total of your Michigan sales of tangible personal property including cash, credit and installment transactions and any costs incurred before ownership of the property is transferred to the buyer (including shipping, handling, and delivery charges).

Line 1b: This line is used to report the following:

•

•Lessors of tangible personal property: Enter amount of total rental receipts.

•Persons providing accommodations: This would include but not limited to hotel, motel, and vacation home rentals. This also includes assessments imposed under the Convention and Tourism Act, the Convention Facility Development Act, the Regional Tourism Marketing Act, the Community Convention or Tourism Marketing Act.

•Telecommunications Services: Enter gross income from telecommunications services.

Line 2a: Total sales tax. Negative figures are not allowed or valid.

Line 2b: Total use tax. Negative figures not allowed or valid.

Line 5: Enter total allowable discounts. Discounts apply only to 2/3 (0.6667) of the sales and/or use tax collected at the 6 percent tax rate. See below to calculate your discount based on filing frequency:

Monthly Filer

•If the tax is less than $9, calculate the discount by multiplying the tax by 2/3 (.6667).

•Enter $6 if tax is $9 to $1,200 and paid by the 12th, or $9 to $1,800 and paid by the 20th .

•If the tax is more than $1,200 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $1,800 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Quarterly Filer

•If the tax is less than $27, calculate the discount by multiplying the tax by 2/3 (.6667)

•Enter $18 if tax is $27 to $3,600 and paid by the 12th, or $27 to $5,400 and paid by the 20th.

•If the tax is more than $3,600 and paid by the 12th,

calculate discount using this formula: (Tax x .6667 x .0075). The maximum discount is $20,000 for the tax period.

•If the tax is more than $5,400 and paid by the 20th,

calculate discount using this formula: (Tax x .6667 x .005). The maximum discount is $15,000 for the tax period.

Accelerated Filer

•If the tax is paid by the 20th, calculate discount using this formula: (Tax x .6667 x .005). No maximum discount applies.

PaRT 2: USe Tax on ITeMS PURchaSed foR BUSIneSS oR PeRSonal USe

Line 7: To determine your use tax due from purchases and withdrawals, multiply the total amount of your inventory value by 6% (0.06) and enter here.

PaRT 3: WIThholdIng Tax

Line 8: Enter the total Michigan income tax withheld for the tax period.

PaRT 4: ToTal Tax/PayMenT dUe

Line 9: If amount is negative, this is the amount available for

future tax periods (skip lines

Line 10: Enter any payments you submitted for this period, prior to filing the return. If you are using an overpayment from a previous period only enter the amount needed to pay the total liability for this return. In the event an overpayment still exists declare it on the next return you file with a liability. (Liability minus overpayments/prior payment for this period must be greater than or equal to zero).

How to Compute Penalty and Interest

If your return is filed with additional tax due, include penalty and interest with your payment. Penalty is 5% of the tax due and increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate, plus 1 percent.

Refer to www.michigan.gov/taxes for current interest rate information or help in calculating late payment fees.

Document Specs

| Fact Name | Description |

|---|---|

| Governing Laws | The Michigan Department of Treasury 5080 form is issued under the authority of Public Acts 167 of 1933 and 94 of 1937, as amended. |

| Usage Restrictions | This form cannot be used as an amended return. Taxpayers must use the Amended Monthly/Quarterly Return (Form 5092) for that purpose. |

| Reporting Requirements | Taxpayers must report their gross sales, rentals, and services, and calculate the total sales and use tax due, which is based on a rate of 6%. |

| Filing Frequency | The form can be filed monthly or quarterly, and the discount rates vary based on the filing frequency and amount of tax due. |

Fill out Common Templates

5 Criteria for Involuntary Admission Michigan - Facilitates cooperation between families, law enforcement, and the judicial system in mental health matters.

Noc Meaning in Construction - Includes a warning to property owners about statutory requirements, emphasizing the importance of following the established procedure.

For those looking to navigate the requirements for ownership transfer, the Maryland Motor Vehicle Bill of Sale is an important document. By utilizing this necessary Maryland Motor Vehicle Bill of Sale form, buyers and sellers can ensure a smooth transaction process.

Judgement of Divorce Form Michigan - This document serves as the plaintiff’s formal plea to the Michigan courts for the dissolution of their marriage, highlighting issues of contention and desires for resolution.