Free Michigan 2248 Template in PDF

The Michigan 2248 form is a critical document for businesses that wish to make electronic payments for various tax obligations through the Electronic Funds Transfer (EFT) system. Issued by the Michigan Department of Treasury, this form must be completed and submitted to initiate the EFT debit process. It serves multiple purposes, including notifying the department of the taxpayer's intent to file electronically and providing authorization for the state to withdraw funds from the taxpayer's designated bank account. The form requires specific information, such as the taxpayer's name, identification number, and contact details, along with the types of taxes being paid, which can include sales tax, use tax, and corporate income tax, among others. A signature from a responsible officer is necessary, along with a certification section that must be completed by corporations or partnerships. Additionally, a security question is included to enhance account protection. It is important to ensure all information is accurate and complete, as processing may take up to four weeks. For any inquiries, taxpayers can contact the Michigan Department of Treasury directly.

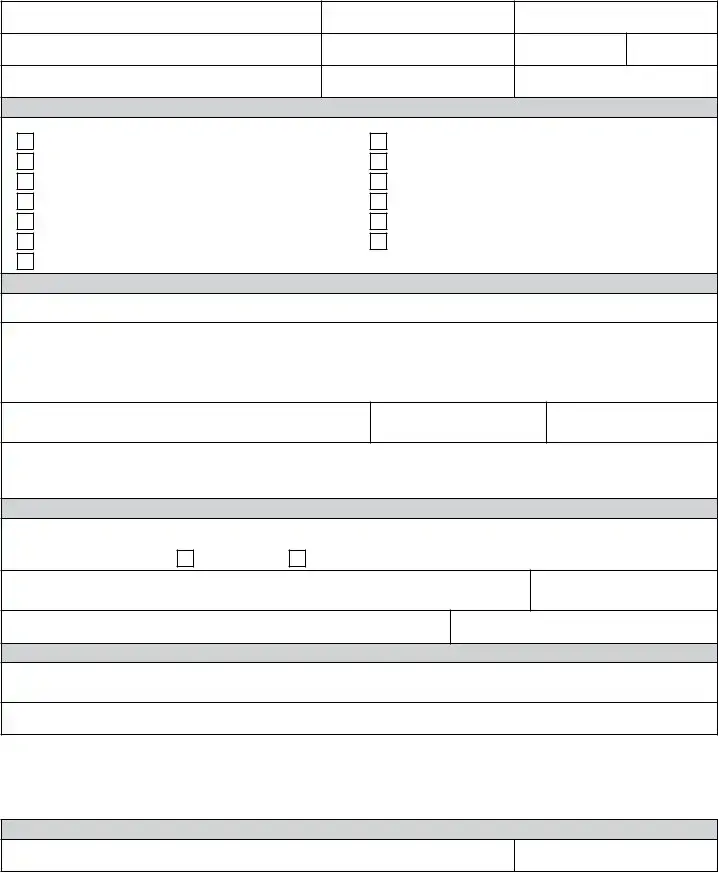

Form Example

Michigan Department of Treasury

Form 2248 (Rev.

Electronic Funds Transfer (EFT) Debit Application

Issued under authority of Public Act 122 of 1941. Filing is mandatory if you wish to pay by EFT.

Use this form to notify us that you intend to file electronically. You may begin electronic filing after you receive our approval and

instructions from Treasury’s authorized contractor for remitting payments.

Taxpayer Name (Type or print clearly)

Taxpayer Identification Number

Address

City

State

ZIP Code

Contact Person

Contact Person Fax Number

Contact Person Telephone Number

INDICATE THE TYPE OF TAX(ES) YOU WILL BE PAYING BY EFT:

Tax Type and Tax Code

Withholding - Employer and Retirement (01100)

Sales Tax (04200)

Use Tax on Sales and Rentals (04400)

Use Tax on Purchases (04500)

Single Business Tax Annual (02671)

Michigan Business Tax Extensions (02355)

Michigan Business Tax Annual (02655)

Corporate Income Tax Annual (02670)

Corporate Income Tax Estimate (02170)

Corporate Income Tax Extensions (02370)

Flow Through Withholding Corporation Quarterly (02010)

Flow Through Withholding Individual Quarterly (02020)

Flow Through Withholding Annual (02675)

AUTHORIZATION FOR EFT DEBITS

If you are interested in making electronic payments of sales, use, withholding and/or Michigan business taxes using the EFT debit method, you must give written permission to access your bank account to withdraw the funds you authorize. Do this by signing below.

I authorize the State of Michigan and its authorized contractor to make variable withdrawals by electronic transfer from the designated financial institution and account. I understand that only the withdrawals I authorize will be made and that this process is protected by a password and a user code. I understand that I may cancel this authorization at any time by sending a written notice to the address noted below. I agree to comply with the National Automated Clearing House Association Rules and Regulations about electronic transfers as they exist on the date of my signature on this form or as subsequently adopted, amended, or repealed. Michigan law governs electronic funds transactions authorized by this agreement in all respects except as otherwise superseded by federal law. If multiple signers are required to authorize a withdrawal of funds, all must sign this form.

Signature of Responsible Officer

Title

Date

Please be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5): “If a corporation, limited liability company, limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for any reason to file the required returns or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on either an audit or an investigation,

have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure |

” |

CERTIFICATION

Corporations, partnerships, LLP’s or LLC’s must complete this section before this form can be processed. This officer, member or partner certification must be resubmitted when there is a change in the individual responsible for filing and/or paying Michigan taxes.

Please check the appropriate box:

New Application

Recertification - Change In Individual Responsible For Michigan Taxes

Signature of Corporate Officer, Partner or Member Responsible for Reporting and/or Paying Michigan Taxes

Date

Type or Print Name

SECURITY

Title

Please Select

The security question is required to complete the processing of your application. Please retain a copy of your answer. A correct response is required when contacting Treasury’s authorized contractor or completing certain updates to your account. You may change the security question and/or

response after successfully accessing your account.

What school did you attend for sixth grade?

All information requested above must be completed and accurate before your application is processed. Please allow 4 weeks for processing. If you have any questions, contact the Michigan Department of Treasury at (517)

Michigan Department of Treasury

Sales Use and Withholding Taxes

P.O. Box 30427

Lansing, MI 48909

TREASURY USE ONLY

Treasury Approval

Date

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan 2248 form is used to apply for Electronic Funds Transfer (EFT) debit payments for various taxes, ensuring a streamlined payment process. |

| Mandatory Filing | Filing this form is mandatory if you wish to pay your taxes electronically via EFT. Without it, electronic payment cannot be initiated. |

| Governing Law | This form is issued under the authority of Public Act 122 of 1941, which governs electronic funds transactions in Michigan. |

| Tax Types | The form allows payment for various taxes, including sales tax, use tax, and corporate income tax, among others. |

| Processing Time | Once submitted, the processing of your application may take up to four weeks. It's important to ensure all information is accurate to avoid delays. |

Fill out Common Templates

What Is Ex Parte Order - A provision in Michigan's legal system for those requiring quick action to avoid significant detriment.

Annulment Michigan Time Limit - Plays a significant role in the administration of divorce law and the efficient handling of cases by the health department.

For those looking to navigate the intricacies of vehicle transactions, a streamlined comprehensive motor vehicle bill of sale is indispensable. This document not only facilitates the transfer of ownership but ensures compliance with Maryland state regulations. To get started with your vehicle sale or purchase, visit this essential resource for the motor vehicle bill of sale.

Mi-1040 Form 2023 - Must be completed if you want to claim withholding on your Michigan tax return for 2009.