Free Michigan 2271 Template in PDF

The Michigan 2271 form, known as the Concessionaire's Sales Tax Return and Payment, is a crucial document for vendors operating within the state. It serves as a means for sellers to report and remit sales, use, and withholding taxes associated with their transactions. This form is not just a routine piece of paperwork; it is a mandatory filing under Michigan law, specifically P.A. 167 of 1933 and P.A. 122 of 1941. Vendors must collect a 6% sales tax on all sales of tangible personal property made during events held in Michigan. This includes everything from merchandise sold at fairs to prizes for games of chance. Additionally, if you utilize goods from your inventory that were purchased exempt from sales tax, you are responsible for remitting use tax on those items. The form also requires reporting wages paid to employees, regardless of where they reside, ensuring compliance with state income tax withholding regulations. Completing the Michigan 2271 accurately and on time is essential; failure to do so may result in estimated tax assessments and penalties. Vendors are encouraged to familiarize themselves with each line of the form and the associated tax obligations to avoid costly mistakes and ensure smooth operations during their events.

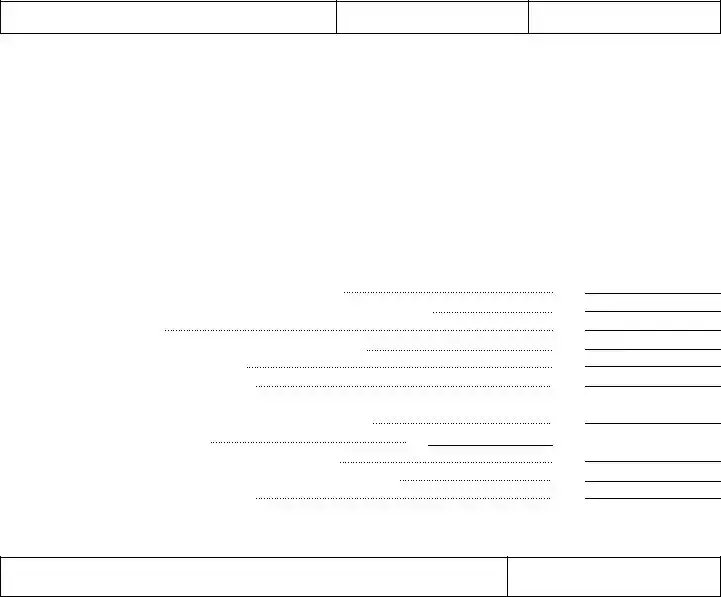

Form Example

Michigan Department of Treasury 2271 (Rev.

Concessionaire's Sales Tax Return and Payment

Issued under P.A. 167 of 1933 and 122 of 1941 as amended. Filing is mandatory.

Seller's Name |

Telephone Number |

Social Security Number |

|

|

|

Street Address |

Sales Tax License No. (if applicable) |

Federal Employer ID Number |

|

|

|

City, State, ZIP Code |

Temporary Liquor License No. (if applicable) |

|

|

|

|

Event

Location (City)

Date of Event

As a vendor operating in Michigan, you are responsible for collecting and paying Michigan sales, use and withholding taxes. You must remit sales tax on all sales of tangible personal property from an event at a Michigan location to an end user ("retail sales") at the rate of 6 percent. You must also remit use tax on all goods taken from inventory or purchased exempt from Michigan sales tax and used in your business unless you paid sales tax of at least 6 percent to another state. For example, prizes given for games of skill or chance.

You must also remit income tax withholding for wages paid to anyone working for you while you are in Michigan, regardless of that person's state of residence. For example, either hiring local people when you are in Michigan or bringing your own employees with you.

Complete each line below as instructed. If you have questions, please contact the Sales, Use and Withholding Tax Customer Contact Division at (517)

1.Gross Sales. Enter the total amount of sales of

tangible personal property including cash and charge sales

2.Enter your purchases for resale on which you paid tax of 6% to your supplier

3.Subtract line 2 from line 1

4.If you include tax in gross sales (line 1), divide line 3 by 17.6667

5.Taxable Sales. Subtract line 4 from line 3

6.Sales Tax Due. Multiply line 5 by 6% (.06)

7.Use Tax Due. Enter 6% (.06) of all purchases made for your own use or consumption on which you did not previously pay 6% sales tax

8. Enter all wages paid to employees |

8. |

9.Income Tax Withholding Due. Enter total withholding due

10.Penalty and Interest Due. Enter amounts due for late payment of tax

11.Pay this Amount. Add lines 6, 7, 9 and 10

CERTIFICATION

I declare, under penalty of perjury, that the information in this return is true and complete.

1.

2.

3.

4.

5.

6.

7.

9.

10.

11.

Seller's Signature

Date

This return is due upon demand. If demand is not made, 3 business days after event. If this form and payment are not mailed to the Michigan Department of Treasury by the due date, an estimated tax assessment may be issued against you.

Make check payable to: STATE OF MICHIGAN.

Mail To: Michigan Department of Treasury

Customer Contact - SUW

P.O. Box 30427

Lansing, MI 48922

Return the white copy with payment.

Keep the yellow copy for your files.

Sales Tax Collection

Retailers are required to remit a 6% sales tax on their taxable retail sales to the State of Michigan. Effective January 1, 2006, a retailer must calculate the amount of sales tax to collect by using the following rounding formula.

To determine the amount of tax to remit, compute the tax to the third decimal place and round up to a whole cent when the third decimal place is greater than four, or down to a whole cent when the third decimal point is four or less.

How to Compute Withholding

To calculate tax amounts to withhold, employers may use a direct percentage computation (example shown below) or use the Michigan Income Tax Withholding Table. This table is found in Form 446, Michigan Income Tax Withholding Guide. Additional information regarding sales, use and withholding taxes, as well as Form 446 and the income tax withholding tables, is available by visiting the Michigan Treasury Web site www.michigan.gov/businesstaxes.

|

2007 |

2006 |

Payroll Period |

Allowance per Exemption |

Allowance per Exemption |

Per Day |

9.32 |

$9.04 |

Weekly |

65.38 |

$63.46 |

Withholding Formula

[Compensation - (allowance per exemption x number of exemptions)] x Calendar Year's Withholding Tax Rate. Example: An employee with 3 exemptions earns $600/week in 2007 - the 2007 withholding tax rate is 3.9%.

The Direct Percentage Calculation is:

[$600 - ($65.38 x 3)] x 3.9% = Amount to withhold [$600 - $196.14] x .039 = $15.75

How to Compute Penalty and Interest

If a return is not filed or tax is not paid within three days of your event, you must include penalty and interest with your payment. Penalty is 5% of the tax due. Penalty increases by an additional 5% per month or fraction thereof, after the second month, to a maximum of 25%. Interest is charged daily using the average prime rate, plus 1 percent.

You may refer to our Web site for current interest rate information, or help in calculating late payment fees.

www.michigan.gov/treasury

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan 2271 form is used for reporting and paying sales tax by concessionaires operating in Michigan. |

| Governing Laws | This form is issued under Public Acts 167 of 1933 and 122 of 1941, as amended. |

| Mandatory Filing | Filing the Michigan 2271 form is mandatory for all vendors conducting sales at events in Michigan. |

| Sales Tax Rate | The sales tax rate applicable to retail sales in Michigan is 6 percent. |

| Income Tax Withholding | Vendors must withhold income tax for wages paid to employees working in Michigan, regardless of their state of residence. |

| Late Payment Penalties | If taxes are not paid within three days of the event, penalties and interest will apply, starting at 5% of the tax due. |

| Event Reporting | Vendors must report gross sales, taxable sales, and any applicable use tax on the form. |

| Contact Information | For questions, vendors can contact the Sales, Use and Withholding Tax Customer Contact Division at (517) 636-4730. |

| Submission Instructions | Payments and the completed form should be mailed to the Michigan Department of Treasury, along with the white copy of the form. |

Fill out Common Templates

What Is a Life Scan - Ingrains a methodical approach for applicants to have their records corrected, thereby upholding the principles of accuracy and fairness in state and federal databases.

To ensure compliance with eviction procedures, it’s important for landlords to accurately complete and serve the Illinois PDF Forms, which provide the necessary legal framework for notifying tenants to vacate the premises.

5 Criteria for Involuntary Admission Michigan - Important for documenting the due diligence performed by petitioners in seeking medical evaluation for an individual.