Free Michigan 2368 Template in PDF

The Michigan 2368 form, also known as the Principal Residence Exemption (PRE) Affidavit, plays a crucial role for homeowners looking to reduce their property tax burden. Issued by the Michigan Department of Treasury, this form allows eligible property owners to claim an exemption from a portion of local school operating taxes, provided they occupy the property as their principal residence. By filing this affidavit with the local assessor, homeowners assert their eligibility for tax relief, but it’s important to note that submitting this form will invalidate any previous exemptions claimed. The form requires detailed property information, including the property tax identification number and the owners' personal details, such as Social Security numbers. Additionally, homeowners must certify that the information is accurate under penalty of perjury. The process is straightforward, but it must be completed by May 1 of the tax year in question to ensure timely adjustments on tax bills. If you own a multi-unit property or have recently changed your principal residence status, special considerations apply, including the need to calculate the percentage of the property you occupy. Understanding these aspects is vital for anyone looking to take advantage of the benefits offered by the Michigan 2368 form.

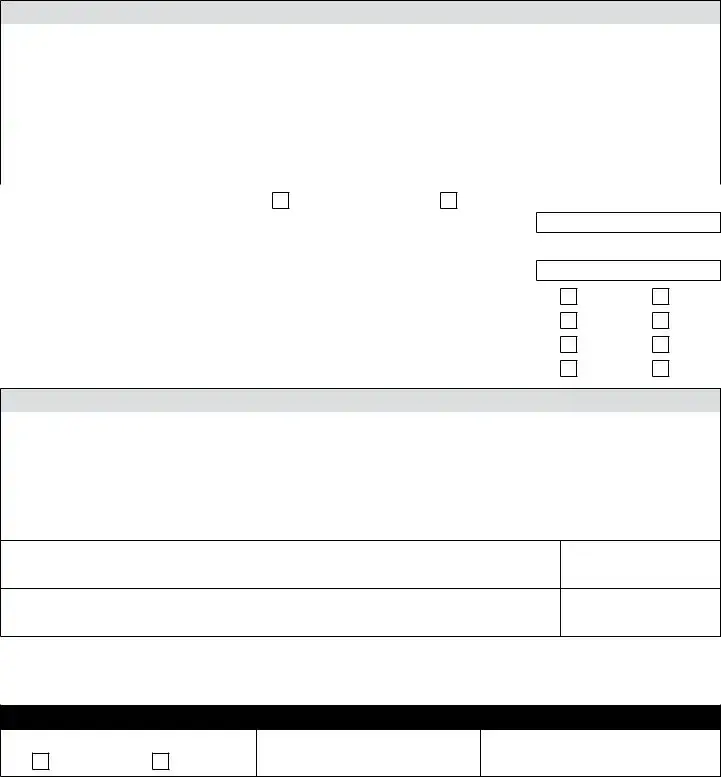

Form Example

Michigan Department of Treasury 2368 (Rev.

Principal Residence Exemption (PRE) Afidavit

Issued under authority of Public Act 206 of 1893.

Read the instructions page before completing the form. Completion of this Afidavit constitutes a claim for a Principal Residence Exemption (PRE) when iled with the local assessor of the city or township where the property is located. Filing this Afidavit invalidates any previous PRE the homeowner may have claimed. A Request to Rescind Principal Residence Exemption (PRE) (Form 2602) or a Conditional Rescission of Principal Residence Exemption (PRE) (Form 4640) must be iled with the local assessor for any previous claims.

Print or type in blue or black ink. Use a separate form for each property number.

PART 1: PROPERTY INFORMATION

4Property Tax Identiication Number |

|

|

Name of City, Township or Village (taxing authority) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

Township |

|

Village |

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

4Street Address of Property |

4City |

|

4State |

4ZIP Code |

|

|

County |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

4Owner’s First, Middle and Last Names |

|

4Social Security Number |

|

|

4Telephone Number |

|

|

||||

|

|

|

|

|

|

|

|

||||

|

4Social Security Number |

|

|

4Telephone Number |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

1. The property above is my |

4 |

Principal Residence

Residential Unoccupied Contiguous or Adjacent Lot

|

|

4 |

2. |

Date the property became your principal residence (mm/dd/yyyy) |

|

3. |

If this parcel has more than one home on it, or if you own and live in one unit of a |

|

|

(or a |

|

|

|

4 |

|

residence) occupies. Your exemption will be based on this percentage |

|

4.Have you claimed a principal residence exemption for another Michigan principal residence? ..............................

5.If yes, have you rescinded that principal residence exemption? ..............................................................................

6.Do you or your spouse claim an exemption, credit or deduction on property located in another state? ..................

7.Have you or your spouse iled a tax return as a resident of another state? .............................................................

%

Yes |

No |

Yes |

No |

Yes |

No |

Yes |

No |

PART 2: CERTIFICATION

Owner’s Mailing Address (If different from property address above) |

City |

|

State |

ZIP Code |

|

|

|

|

|

Closing Agent or Preparer’s First Name |

|

Last Name |

|

|

|

|

|

|

|

Closing Agent or Preparer’s Mailing Address |

City |

|

State |

ZIP Code |

|

|

|

|

|

Certiication: I certify under penalty of perjury the information contained on this document is true and correct to the best of my knowledge.

Owner’s Signature

Date

Date

LOCAL GOVERNMENT USE ONLY (do not write below this line)

Was an exemption in place prior to this afidavit being iled?

Yes |

No |

4First year exemption to be posted to tax rolls?

Property Classiication

2368, Page 2

Instructions for Form 2368

Principal Residence Exemption (PRE) Afidavit

If you own and occupy your principal residence, it may be exempt from a portion of your local school operating taxes. To claim an

exemption, complete this Afidavit and ile it with your township or city by May 1 of the year of the claim. Your local assessor will adjust

your taxes on your next property tax bill. Note that this is an exemption from part of the taxes and does not affect your assessment.

Principal residence means the dwelling that you occupy as your permanent home and any unoccupied adjacent or contiguous properties that are classiied residential.

Owning means you hold the legal title to the principal residence or that you are currently buying it on a notarized or recorded land contract. Renters should not ile this form.

Occupying means this is your principal residence, the place you intend to return to whenever you go away. It may be the address that appears on your driver's license or voter registration card. Vacation homes and income property that you do not occupy as your principal residence may not be claimed. You may have only one principal residence at a time, however, you can ile a Conditional Rescission of Principal Residence Exemption (PRE) (Form 4640) on unsold property that is your previous principal residence under the

following conditions: it is for sale, is not occupied, is not leased, and is not used for any business or commercial purpose.

RESCINdING YOUR ExEMPTION

If you claim an exemption and then stop using it as a principal residence, you must notify your township or city assessor within 90 days of

the change or you may be penalized. This can be done using the Request to Rescind Principal Residence Exemption (PRE) (Form 2602) or iling Form 4640, as noted above.

INTEREST ANd PENALTY

If it is determined that you claimed property that is not your principal residence, you may be subject to the additional tax plus penalty

and interest as determined under the General Property Tax Act.

PART 1: PROPERTY INFORMATION

Submit a separate afidavit for each property tax identiication number being claimed.

It is imporatant that your property tax identiication number is entered accurately. This ensures that your property is identiied properly and that your township or city can accurately adjust your property taxes. You can ind this number on your tax bill and on your property tax assessment notice. If you cannot ind this number, call your township or city assessor.

NOTE: Do not include information for a

The request for the Social Security number is authorized under Section 42 USC 405 (c) (2) (C) (i). It is used by the Department of

Treasury to verify tax exemption claims and to deter fraudulent ilings. Any use of the number by closing agents or local units of government is illegal and subject to penalty.

Line 3: If you own and live in a

If the parcel of property you are claiming has more than one home on it, you must determine the percentage that you own and occupy

as your principal residence. A second residence on the same property (e.g., a mobile home or second house) is not part of your principal residence, even if it is not rented to another person. Your local assessor can tell you the assessed value of each residence to help you

determine the percentage that is your principal residence.

If you rent part of your home to another person, you may have to prorate your exemption. If your home is a

PART 2: CERTIFICATION

Sign and date the form. Enter your mailing address if it is different from the address under Part 1.

MAILING INFORMATION

Mail your completed form to the township or city assessor where the property is located. This address may be on your most recent tax

bill or assessment notice. Do NoT send this form directly to the Department of Treasury.

If you have any questions, visit our Web site at www.michigan.gov/PRE or call (517)

Document Specs

| Fact Name | Description |

|---|---|

| Form Title | Michigan Department of Treasury 2368 - Principal Residence Exemption (PRE) Affidavit |

| Governing Law | Issued under authority of Public Act 206 of 1893 |

| Purpose | This form is used to claim a Principal Residence Exemption for property tax purposes. |

| Filing Deadline | The affidavit must be filed by May 1 of the year for which the exemption is claimed. |

| Impact of Filing | Filing this affidavit invalidates any previous PRE claims by the homeowner. |

| Multiple Properties | A separate form is required for each property tax identification number. |

| Certification Requirement | Owners must certify that the information provided is true under penalty of perjury. |

| Owner's Information | Owners must provide their full names, Social Security numbers, and contact information. |

| Rescission Process | To rescind a previous exemption, homeowners must file Form 2602 or Form 4640. |

| Local Assessor Role | The local assessor is responsible for adjusting property taxes based on the exemption claim. |

Fill out Common Templates

Michigan Molina Prior Authorization - Clinical notes and supplementary materials are mandatory for a comprehensive review, underscoring the importance of detailed medical documentation.

To further ensure that your sensitive information is kept confidential, consider utilizing resources like Illinois PDF Forms, which can guide you through the process of creating and implementing a robust Non-disclosure Agreement.

Waive a Fee - Emphasizes the importance of truthfulness in declaring financial information to the court.

Michigan Workers Independent Contractor Worksheet - The document underscores the importance of sole proprietors understanding their responsibilities and rights under Michigan workers' compensation laws.