Free Michigan 3683 Template in PDF

The Michigan 3683 form serves as a vital tool for businesses operating within the state, particularly when it comes to managing withholding tax responsibilities. This form, officially titled the Payroll Service Provider Combined Power of Attorney Authorization and Corporate Officer Liability Certificate, allows business owners to appoint a payroll service provider or individual to act on their behalf in matters related to income tax withholding. By filling out this form, businesses can streamline their interactions with the Michigan Department of Treasury, ensuring that all necessary tax information is handled efficiently. The form requires essential details such as the taxpayer's name, address, and contact information, along with the payroll service provider's details. Importantly, the authorization granted remains in effect until the business notifies the Treasury in writing of any changes. Additionally, the form highlights the potential personal liability of corporate officers and partners, emphasizing the importance of compliance with tax regulations. Completing this form correctly is crucial for businesses to avoid penalties and maintain good standing with the state. For any questions or assistance, the Michigan Department of Treasury provides resources to guide businesses through the process.

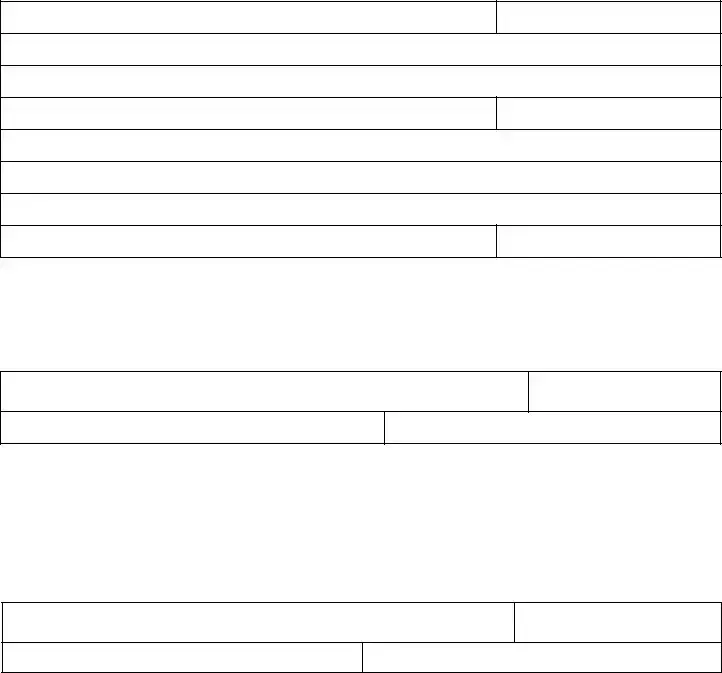

Form Example

Michigan Department of Treasury |

36 |

3683 (Rev. |

Payroll Service Provider Combined Power of Attorney Authorization and Corporate Officer Liability (COL) Certificate for Businesses

Issued under authority of the Revenue Act, P.A. 122 of 1941, as amended. Filing is voluntary.

Complete this form if you wish to appoint someone to represent your business to the State of Michigan for withholding tax matters.

Taxpayer Name

Address (Street or RR#)

City, State, ZIP Code

Contact Person

Payroll Service Name

Address (Street or RR#)

City, State, ZIP Code

Contact Person

Account No./Federal Employer ID No. (FEIN)

Telephone Number

Telephone Number

Effective _________________________ (mo/day/yr), the

represent my business and receive information in reference to all Treasury income tax withholding matters until I notify the Michigan Department of Treasury in writing that this Power of Attorney is revoked.

Taxpayer's Power of Attorney Authorization

Must be signed by an authorized representative of the business. I certify that I have the authority to execute this Power of Attorney.

Signature

Date

Type or Print Name

Title

Please be aware of officer, member or partner liability as provided in Michigan Compiled Laws 205.27a(5):

"If a corporation, limited liability company, limited liability partnership, partnership, or limited partnership liable for taxes administered under this act fails for any reason to file the required returns or pay the tax due, any of its officers, members, managers, or partners who the department determines, based on either an audit or an investigation, have control or supervision of, or responsibility for, making the returns or payments is personally liable for the failure......."

CERTIFICATION

Corporations, partnerships, LLP's or LLC's must complete this section before this form can be processed. This officer, member or partner certification must be resubmitted when there is a change in the individual responsible for filing and/or paying Michigan taxes.

Signature of Corporate Officer, Partner, or Member responsible for reporting and/or paying Michigan taxes

Date

Type or Print

Title

If you have any questions, please contact the Michigan Department of Treasury at (517)

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan 3683 form is used to appoint a payroll service provider or individual to represent a business for withholding tax matters. |

| Governing Law | This form is issued under the authority of the Revenue Act, P.A. 122 of 1941, as amended. |

| Filing Status | Filing the Michigan 3683 form is voluntary, allowing businesses to choose whether to appoint a representative. |

| Authorization Duration | The authorization remains effective until the business revokes it in writing to the Michigan Department of Treasury. |

| Liability Information | According to Michigan Compiled Laws 205.27a(5), certain officers or partners may be personally liable for unpaid taxes if the business fails to file or pay. |

| Certification Requirement | Corporations, partnerships, LLPs, or LLCs must complete a certification section before the form can be processed. |

| Contact Information | For questions, businesses can contact the Michigan Department of Treasury at (517) 636-4660. |

| Submission Methods | The form can be submitted via fax at (517) 636-4520 or mailed to the Michigan Department of Treasury. |

Fill out Common Templates

Michigan 4363 - The Michigan 4363 form is aimed to facilitate children of certain veterans to apply for educational opportunities under the Children of Veterans Tuition Grant Program.

Civil Lawsuit Michigan - Details on how to complete the Answer form, including filling in court and personal information, are provided.

For those looking to effectively complete a transaction, having the right documentation is key. Using a well-prepared form saves time and ensures compliance with state requirements. You can find an excellent resource for a "thorough Motor Vehicle Bill of Sale" at https://marylandformspdf.com/blank-motor-vehicle-bill-of-sale/.

3636A Michigan - This form provides a secure method for vendors to have their payments directly deposited into their bank accounts.