Free Michigan 3778 Template in PDF

The Michigan 3778 form, also known as the Three Day Payment Voucher, plays a crucial role in the state's tax collection process for imported and diverted motor fuels. This form is mandatory for individuals and businesses importing fuel from outside the United States or diverting fuel originally intended for export to a destination within Michigan. Timeliness is essential; taxes must be reported and paid within three business days of the relevant event to avoid penalties. The form requires detailed information, including the company name, account number, contact details, and specific data about the fuel being imported or diverted, such as product names, codes, and gallons. Tax rates vary by fuel type, with gasoline products generally taxed at $0.19 per gallon, undyed diesel at $0.15, and aviation fuel at $0.03. Additionally, the form provides space for calculating total tax due, penalties for late filing, and interest, ensuring that all financial obligations are clearly outlined. Accurate completion of the Michigan 3778 form is vital, as it includes declarations under penalty of perjury, emphasizing the importance of honesty and accuracy in reporting. Understanding the requirements and instructions laid out in this form can help businesses navigate the complexities of fuel taxation in Michigan.

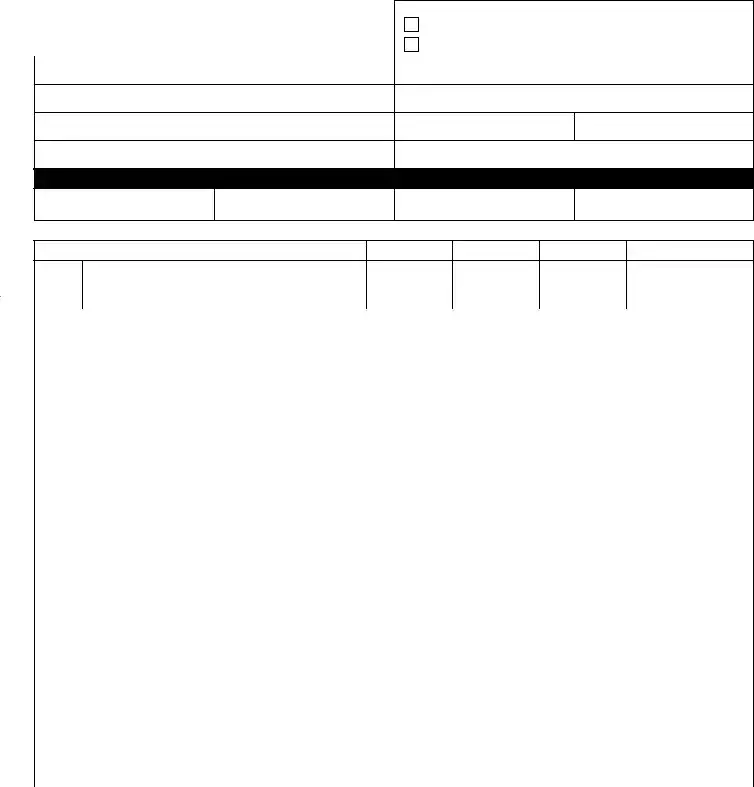

Form Example

Michigan Department of Treasury |

|

3778 (Rev. |

Reason for |

|

Three Day Payment Voucher |

|

|

Import from outside the United States |

Issued under authority of P.A. 403 of 2000, as amended. Filing is mandatory. |

|

|

Diversion requiring |

|

|

||

|

|

|

|

Company Name |

Account Number (FEIN or TR) |

||

|

|

|

|

DBA

Contact Person Name

Address (Street, RR#, P.O. Box)

Telephone Number

Fax Number

City, State, ZIP

IMPORT/DIVERSION INFORMATION

Date Import Entered Michigan

Document Number

Import Verification/Diversion Number

Date Verification Number Assigned

Enter Product Name, Codes and Gallons. See page 2 for instructions, product classification and codes.

Gasoline Products |

Product Codes |

Gallons |

Tax Rate |

Calculated Tax Due |

|

|

|

|

|

1. |

Gasoline |

065 |

|

x .19 |

1. |

2. |

Product Name |

|

|

x .19 |

2. |

Ethanol |

Products E70 - E99 |

|

|

|

3. |

3. |

Product Name |

E____ |

|

x .19 |

3. |

Undyed Diesel Products (see instructions on page 2) |

|

|

|

|

|

4. |

Undyed Diesel |

160 |

|

x .15 |

4. |

5. |

Product Name |

|

|

x .15 |

5. |

|

|

|

|||

Undyed |

Biodiesel Products B05 - B00 |

|

|

|

|

6. |

Product Name |

B____ |

|

x .15 |

6. |

|

|

|

|||

Dyed Diesel Products (dyed to U.S. Standards) |

|

|

|

|

|

7. |

Dyed Diesel |

228 |

|

x .00 |

7. |

Dyed |

Biodiesel |

|

|

|

|

8. |

Product Name |

D____ |

|

x .00 |

8. |

Aviation Products |

|

|

|

|

|

9. |

Aviation Fuel |

125 |

|

x .03 |

9. |

10. |

Jet Fuel |

130 |

|

x .03 |

10. |

Miscellaneous |

|

|

|

|

|

11. |

Product Name |

|

|

x ____ |

11. |

Tax Calculation |

|

|

|

|

|

12. Total Tax Due. Add lines 1 through 11 |

|

|

12. |

|

|

|

|

|

|

|

|

13. Penalty for late filing (100%). Enter amount from line 12 |

13. |

|

|||

|

|

|

|

|

|

14. Interest. (1% above prime rate set January 1 and July 1 of each year) |

14. |

|

|||

15. TOTAL REMITTANCE. Add lines 12, 13 and 14 |

|

|

15. |

|

|

Under penalty of perjury, I declare that I have examined this voucher, and to the best of my knowledge and belief, it is correct and complete.

Authorized Signature |

|

Signature of Preparer |

|

|

|

I authorize Treasury to discuss my return and attachments with my preparer. |

|

Do not discuss my return with my preparer. |

|||

|

|

|

|

|

|

Printed Name |

|

Printed Name |

|

Preparer FEIN |

|

|

|

|

|

|

|

Title |

|

Address |

|

|

|

|

|

|

|

||

Telephone Number |

Date |

Telephone Number |

Date |

||

|

|

|

|

|

|

Questions ???? - Please call (517)

3778, Page 2

Instructions for Form 3778, Three Day Payment Voucher

General Information - Tax is due on imported or diverted motor fuel within 3 business days after either of the following events:

•Imports from outside the United States by persons other than licensed Bonded Importers or Suppliers, when tax is not paid to supply source. An import verification number must be obtained prior to import.

•Diversions on all fuel intended for export from Michigan but diverted to a destination within Michigan. A diversion number must be obtained prior to the diversion. Attach a copy of Form 3750, SCHEDULE OF DIVERSION (11B) and/or a shipping document.

•Diversions by unlicensed importers on all fuel acquired outside Michigan, not intended for a Michigan destination, but diverted to Michigan. A diversion number must be obtained prior to the diversion. Attach a copy of Form 3750, SCHEDULE OF DIVERSION (11A) and/or a shipping document.

Payments not postmarked within three business days of the event are subject to 100% penalty, plus interest.

TO OBTAINAPPROPRIATEAUTHORIZATION CALL:

Import Verification Number

To obtain a Diversion Number, log on to www.trac3.net. If you do not have access to the Internet, contact Motor Fuel at (517)

Instructions

Occasional Importers must include all products and payments reported on this Three Day Payment Voucher, and also on their quarterly Fuel Importer Return.

Provide all requested information: company name, complete address, federal employer identification number, contact person and telephone number, Date Import Entered Michigan, Document Number (bill of lading, manifest), Import Verification/Diversion Number, Date Authorization Number Assigned (either Import Verification Number or Diversion Number).

Report gallons being imported or diverted on the appropriate line of the Voucher (page 1, lines 1 through 11).

If the product being imported or diverted is not

Diesel fuel dyed to Canadian standards must be reported as undyed diesel and applicable taxes must be paid.

Line 11, Miscellaneous: Enter name and product code (if applicable) of the miscellaneous product.

(a)If additional space is needed for a product, use line 11 to identify the fuel type. Multiply the gallons on line 11 by the appropriate tax rate.

(b)All other unidentified products: enter the name of the product, product code 092, the number of gallons and 0.19 in the tax rate column. Multiply the gallons by 0.19.

Fuel type categories and product codes: The tax rates and most common product and product code are listed below. See our Web site at www.michigan.gov/treasury for additional products and product codes.

Fuel Types and Product Codes |

|

Tax Rate |

|||

|

|

|

|

(per gallon) |

|

|

|

|

|||

Gasoline Products E01 - E69, E00 (denatured) (1% - 69%, and 100%) including: |

|

|

|||

065 |

- Gasoline |

199 - Toluene |

|

$.19 |

|

100 |

- Transmix |

092 - Undefined Other Product |

|

|

|

126 |

- Napthas |

|

|

|

|

Ethanol Products E70 - E99 (70% - 99%): |

|

|

|

||

E plus percentage (limit 2 digits) |

|

$.19 |

|

||

Undyed Biodiesel B05 - B00 (5% - 100%): |

|

|

|

||

B plus percentage (limit 2 digits) |

|

$.15 |

|

||

|

|

|

|

||

Dyed Biodiesel D01 - D00 (1% - 100%) |

|

|

|

||

D plus percentage (limit 2 digits) |

|

$.00 |

|

||

|

|

|

|||

Undyed Diesel Products (including diesel dyed to Canadian standards) including: |

|

|

|||

160 |

- Undyed Diesel |

142 - Undyed Kerosene |

281 - Mineral Oils |

$.15 |

|

B01 - B04 Biodiesel Blend (1% - 4%) |

(including mineral spirits) |

|

|

||

|

|

|

|||

Dyed Diesel Products (diesel dyed to US standards) including: |

$.00 |

|

|||

228 - Dyed Diesel |

072 - Dyed Kerosene |

|

|

|

|

Aviation Products including: |

|

$.03 |

|

||

125 - Aviation Gasoline |

130 - Jet Fuel |

|

|

|

|

|

|

|

|

|

|

Document Specs

| Fact Name | Description |

|---|---|

| Purpose | The Michigan 3778 form is a Three Day Payment Voucher for taxes on imported or diverted motor fuel. |

| Governing Law | This form is issued under the authority of Public Act 403 of 2000, as amended. |

| Filing Requirement | Filing the Michigan 3778 form is mandatory for applicable transactions. |

| Payment Deadline | Payments must be postmarked within three business days of the import or diversion event. |

| Penalties | Late payments incur a 100% penalty, along with interest calculated at 1% above the prime rate. |

| Contact Information | For questions, individuals can call the Michigan Department of Treasury at (517) 636-4600. |

Fill out Common Templates

1098 Tax Form - The form includes a section to describe any felony or misdemeanor convictions within the past ten years, with additional space if needed.

In order to ensure a smooth transaction when purchasing a vehicle, it's important to have the proper documentation. You can find a helpful template for a Maryland Motor Vehicle Bill of Sale in our guide, which outlines the necessary information you'll need to complete the process efficiently: valuable Motor Vehicle Bill of Sale resource.

Michigan Sales Tax Exemption Form - Details about the business, such as the official name, owner names, and the date the business began within the local tax collecting unit, are required for this exemption claim.