Free Michigan 3891 Template in PDF

The Michigan 3891 form is an essential tool for businesses seeking to recover prepaid sales tax on gasoline. This form, issued by the Michigan Department of Treasury, allows eligible businesses to request a refund for any overpayment of sales tax. It is important to note that filing this form is voluntary, providing businesses with the option to reclaim funds that may have been mistakenly paid. The form requires basic information such as the business name, Federal Employee Identification Number (FEIN), and contact details. Additionally, businesses must detail the tax reporting period and the amount overpaid, culminating in a total overpayment figure. To ensure accuracy and compliance, the form includes a certification section where the authorized representative must attest to the truthfulness of the information provided. Once completed, the form can be submitted via fax or mail to the appropriate department. For any inquiries, businesses can reach out to the Customer Contact Division for assistance. Understanding the Michigan 3891 form can help businesses navigate the refund process effectively, allowing them to reclaim funds and maintain financial health.

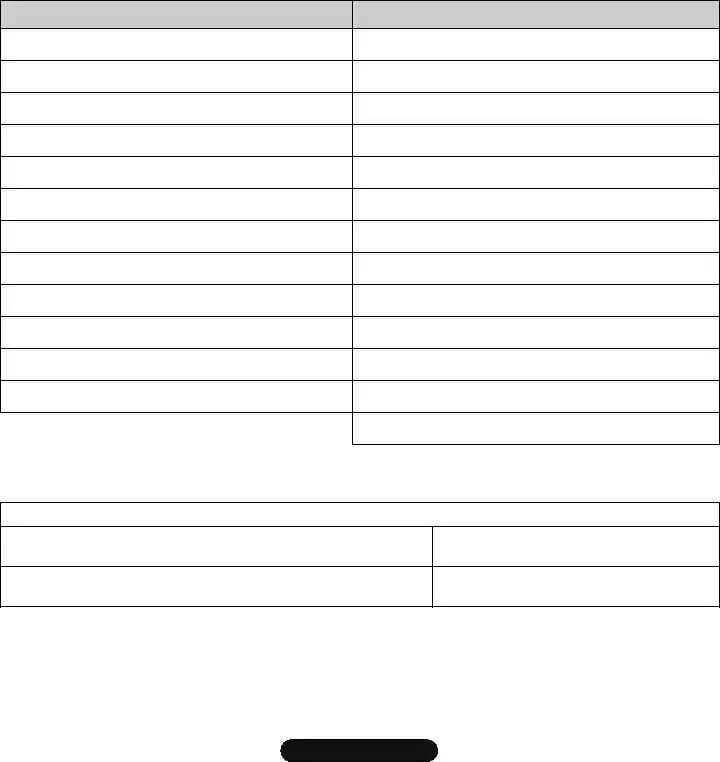

Form Example

Michigan Department of Treasury 3891 (Rev.

Refund Request for Prepaid Sales Tax on Gasoline

Issued under the authority of Public Act 167 of 1933. Filing is voluntary.

Business Name |

Federal Employee Identification Number (FEIN) |

|

|

|

|

|

|

Business Address (No., Street) |

City |

State |

ZIP Code |

|

|

|

|

OVERPAYMENT DETAIL

Tax Reporting Period

Amount Overpaid

TOTAL OVERPAYMENT

CERTIFICATION

I certify under penalty of perjury that I have examined this request and to the best of my knowledge and belief, it is true and correct.

Authorized Signature

Telephone Number

Name and Title Printed

Date

Fax the completed form to (517)

Michigan Department of Treasury Lansing, MI 48922.

If you have questions, call (517)

www.michigan.gov/treasury

Document Specs

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to request a refund for prepaid sales tax on gasoline. |

| Governing Law | The form is issued under the authority of Public Act 167 of 1933. |

| Filing Status | Filing a request using this form is voluntary. |

| Required Information | Businesses must provide their name, FEIN, address, and details about the overpayment. |

| Certification Requirement | The requester must certify that the information provided is true and correct under penalty of perjury. |

| Submission Methods | The completed form can be faxed or mailed to the Michigan Department of Treasury. |

| Contact Information | For questions, businesses can call (517) 636-4730. |

Fill out Common Templates

1098 Tax Form - The application details the necessity for a $10,000.00 surety bond and a $10.00 filing fee for prospective notaries.

Before you begin the process of filling out the necessary paperwork, you can find the essential Illinois PDF Forms that will guide you in completing your motorcycle transaction correctly and efficiently.

Unemployment Login Michigan - Payment details, including how pay was determined and whether deductions were taken, are essential parts of this form.