Free Michigan 3924 Template in PDF

The Michigan 3924 form, also known as the Withholding Tax Schedule, plays a crucial role for individuals who had Michigan income tax withheld during the tax year. This form is essential for claiming withholding amounts on your Individual Income Tax Return, specifically on line 34 of the MI-1040. To ensure a smooth filing process, it is important to attach the completed Schedule W to your MI-1040 or MI-1040X as required. The form requires basic personal information, including names and Social Security numbers for both the filer and spouse if applicable. It consists of two main tables: Table 1 captures Michigan tax withheld from W-2, W-2G, or corrected W-2 forms, while Table 2 focuses on tax withheld from 1099 and 4119 forms. Completing these tables accurately is vital, as they summarize your taxable income and the corresponding taxes withheld. Furthermore, the instructions emphasize the importance of not submitting W-2 or 1099 forms with your return, but rather keeping them for your records. By following the guidelines provided on the form, you can ensure that your tax return is processed efficiently and without unnecessary delays.

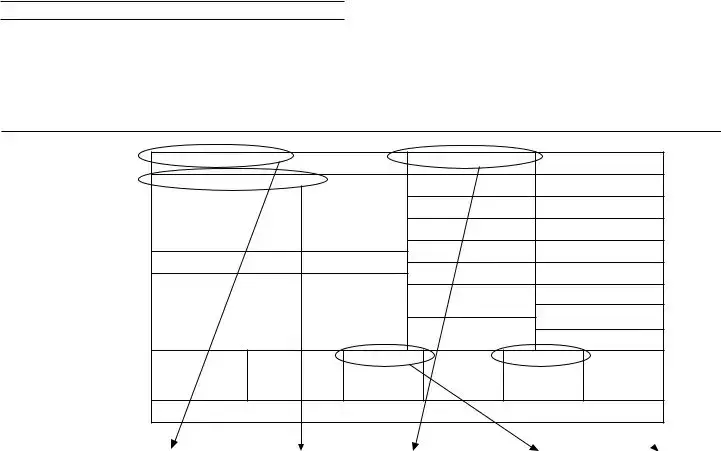

Form Example

Michigan Department of Treasury |

Schedule W |

|

3924 (Rev. |

||

|

||

2009 MICHIGAN Withholding Tax Schedule |

|

|

Issued under authority of Public Act 281 of 1967. |

|

INSTRUCTIONS: If you had Michigan income tax withheld in 2009, you must complete a Withholding Tax Schedule (Schedule W) to claim the withholding on your Individual Income Tax Return

Print numbers like this : 0123456789 - NOT like this: |

1 4 |

|

|

|

|

|

|

|

|

|

Attachment 13 |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Filer’s First Name |

M.I. |

Last Name |

|

|

4Filer’s Social Security Number (Example: |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If a Joint Return, Spouse’s First Name |

M.I. |

Last Name |

|

|

|

Spouse’s Social Security Number (Example: |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TABLE 1: MICHIGAN TAX WITHHELD ON |

|

|

|

|

||||||||||||||

4A |

4B |

|

|

C |

|

D |

4E |

|

F |

|||||||||

Enter “X” |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

if for: |

Box b - Employer’s federal |

|

|

|

|

Box 1 - Wages, tips, |

Box 17 - Michigan |

|

Box 19 - City |

|||||||||

You or Spouse |

identiication number |

|

|

Employer’s name |

|

other compensation |

income tax withheld |

income tax withheld |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

00 |

|

|

00 |

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||||

|

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

00 |

||||

Enter Table 1 Subtotal from additional Schedule W forms (if applicable) |

|

00 |

|

00 |

||||||||||||||

1. SUBTOTAL. Enter total of Table 1, columns E and F. Carry total of column F to |

|

|

|

|

|

|

|

|

||||||||||

|

the City Income Tax Worksheet in the |

|

00 |

|

00 |

|||||||||||||

IMPORTANT: If you have no entries for Table 2, carry total of line 1, column E, to line 3 below.

TABLE 2: MICHIGAN TAX WITHHELD ON 1099 and 4119 FORMS

4A |

4B |

C |

D |

4E |

|

F |

||

Enter “X” |

|

|

Taxable pension |

|

|

|

||

if for: |

Payer’s federal |

|

distribution, misc. |

Michigan income |

|

Box 7 - Distribution |

||

You or Spouse |

identiication number |

Payer’s name |

income, etc. (see instr.) |

tax withheld |

|

Code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

|

|

|

|

|

00 |

|

00 |

|

Enter Table 2 Subtotal from additional Schedule W forms (if applicable) |

|

|

|

00 |

|

|||

2. SUBTOTAL. Enter total of Table 2, column E |

2. |

|

00 |

|

||||

3. TOTAL. Add line 1 and line 2, column E. Carry total to your |

43. |

00

+ 0000 2009 57 01 27 3

2009 Schedule W, Page 2

Instructions for Schedule W

Withholding Tax Schedule

Schedule W is designed to report State of Michigan and Michigan city income tax withholding. Schedule W is

imaged to enable us to process your individual income tax return more eficiently.

Attach the completed Schedule to your return.An attachment number is listed in the upper right corner to help you assemble your form in the correct order behind your

attached when required, the processing of your return

may be delayed. Do not submit

W.Keep copies of your

Michigan Residents. If you paid income tax to a governmental unit outside of Michigan, see instructions for

Schedule 2, line 5.

Completing the Withholding Tables

Lines not listed are explained on the form.

Complete the withholding tables using information from your

that contain Michigan tax withheld. If you need additional space, attach another Schedule W.

Column D

Table 1: From

Table 2: From 1099 or 4119 forms, or other withholding documents, enter unemployment compensation, taxable interest, ordinary dividends, miscellaneous income, bartering, taxable pension distributions in excess of contributions, state and local income tax refunds, credits or offsets, rents, royalties, and/or other taxable income from which Michigan tax was withheld.

Column F

Table 1: Enter city income tax withheld from Michigan

cities only.

Table 2: Enter Distribution Code from your

applicable).

Line 1: Subtotal. Enter the total of Table 1, columns E and

F.Carry total from Table 1, column F, to the City Income Tax Worksheet in the

Line 3: Total. Enter total of line 1 from Table 1 and line 2 from Table 2 on line 3 and carry total to Form

Sample

b. Employer Identiication Number |

1. Wages, tips, other comp. |

c. Employer’s name, address and ZIP code |

|

|

|

17. State income tax |

19. Local income tax |

Form |

2009 |

OMB No. |

Copy C for EMPLOYEE’S RECORDS |

Department of Treasury - Internal Revenue Service |

4A |

4B |

C |

D |

4E |

F |

Enter “X” |

|

|

|

|

|

if for: |

Box b - Employer’s federal |

|

Box 1 - Wages, tips, |

Box 17 - Michigan |

Box 19 - City |

You or Spouse |

identiication number |

Employer’s Name |

other compensation |

income tax withheld |

income tax withheld |

Document Specs

| Fact Name | Description |

|---|---|

| Form Title | Michigan Department of Treasury Schedule W 3924 |

| Revision Date | Revised in September 2009 |

| Governing Law | Issued under authority of Public Act 281 of 1967 |

| Purpose | Used to report Michigan income tax withheld for the year |

| Filing Requirement | Must be completed if Michigan income tax was withheld in 2009 |

| Attachment | Attach Schedule W to Form MI-1040 or MI-1040X |

| Completion Instructions | Type or print in blue or black ink; format numbers correctly |

| Tables Included | Contains two tables for reporting tax withheld on W-2 and 1099 forms |

| Record Keeping | Keep copies of W-2s for six years for tax records |

Fill out Common Templates

Michigan Probate Checklist - A credentials document for personal representatives to officially conclude the probate process in Michigan.

For those facing the eviction process, the Illinois Notice to Quit form is not only vital but can also be easily accessed through resources like Illinois PDF Forms, ensuring you have the necessary documentation to proceed correctly.

2022 Michigan Tax Forms - If the total underpayment for the year is $500 or less, Michigan taxpayers do not need to complete this form.