Free Michigan 4568 Template in PDF

The Michigan 4568 form is an essential document for businesses seeking to summarize their nonrefundable tax credits under the Michigan Business Tax (MBT). This form, issued by the Michigan Department of Treasury, plays a critical role in determining a taxpayer’s liability after applying various credits. It allows businesses to report their tax before credits, detail the specific credits they are claiming, and calculate the final tax amount owed. The form includes a series of lines that guide users through the process of entering data from other related forms, such as the 4567 and 4590, ensuring that all applicable credits are accounted for. Notably, the 4568 form caters to both standard taxpayers and financial institutions, although insurance companies must use a different form for their credits. Each credit listed has unique eligibility criteria and carryforward rules, which can affect how businesses report their tax liabilities. By organizing these credits efficiently, the Michigan 4568 form simplifies the tax preparation process, allowing taxpayers to quickly identify which credits apply to them. Ultimately, completing this form accurately is crucial for businesses to maximize their tax benefits and comply with state regulations.

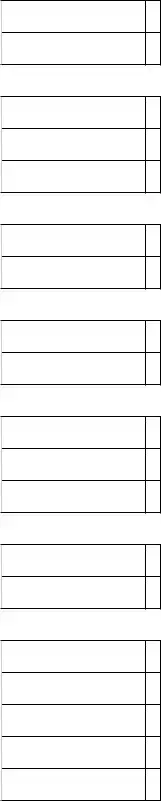

Form Example

Michigan Department of Treasury 4568 (Rev.

Attachment 02

2011 MICHIGAN Business Tax Nonrefundable Credits Summary

Issued under authority of Public Act 36 of 2007.

Name |

Federal Employer Identiication Number (FEIN) or TR Number |

|

|

1. |

Tax before all credits from Form 4567, line 53, or Form 4590, line 26 |

1. |

|||

2. |

SBT credit carryforwards used from Form 4569, line 13 |

2. |

|||

3. |

Tax After SBT credit carryforwards. Subtract line 2 from line 1. |

|

|

|

|

|

If less than zero, enter zero |

3. |

|

00 |

|

4. |

a. Compensation and Investment Tax Credits from Form 4570, line 26 |

|

4a. |

||

|

b. If Form 4570, line 20, is negative, enter here as a negative number. Otherwise, leave blank |

|

4b. |

||

5. |

Research and Development Credit from Form 4570, line 33 |

5. |

|||

6. |

Tax After Research and Development Credit. Subtract lines 4a, 4b |

|

|

|

|

|

and 5 from line 3 (see instructions) |

6. |

|

00 |

|

7. |

Small Business Alternative Credit from Form 4571, line 13 or 19, whichever applies |

7. |

|||

8. |

Gross Receipts Filing Threshold Credit from Form 4571, line 27 |

8. |

|||

9. |

Tax After Gross Receipts Filing Threshold Credit. Subtract lines 7 and |

|

|

|

|

|

8 from line 6 (see instructions) |

9. |

|

00 |

|

10. |

Community and Education Foundations Credit from Form 4572, line 5 |

10. |

|||

11. |

Homeless Shelter/Food Bank Credit from Form 4572, line 9 |

11. |

|||

12. |

Tax After Homeless Shelter/Food Bank Credit. Subtract lines 10 and |

|

|

|

|

|

11 from line 9. If less than zero, enter zero |

12. |

|

00 |

|

13. |

NASCAR Speedway Credit from Form 4573, line 3 |

13. |

|||

14. |

Stadium Credit from Form 4573, line 6 |

|

14. |

||

15. |

If less than zero, enter as a negative number |

15. |

|||

16. |

Tax After |

|

|

|

|

|

line 12. If less than zero, enter zero |

16. |

|

00 |

|

17. |

Public Contribution Credit from Form 4572, line 14 |

17. |

|||

18. |

Arts and Culture Credit from Form 4572, line 19 |

|

18. |

||

19. |

Tax After Arts and Culture Credit. Subtract lines 17 and 18 from line |

|

|

|

|

|

16 (see instructions) |

19. |

|

00 |

|

20. |

Next Energy Business Activity Credit from Form 4573, line 12 |

20. |

|||

21. |

Renaissance Zone Credit from Form 4573, line 14 |

21. |

|||

22. |

Historic Preservation Credit Net of Recapture from Form 4573, line 17b |

22. |

|||

23. |

23. |

||||

24. |

New Motor Vehicle Dealer Inventory Credit from Form 4573, line 27 |

24. |

|||

+ 0000 2011 15 01 27 6

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Continue on Page 2

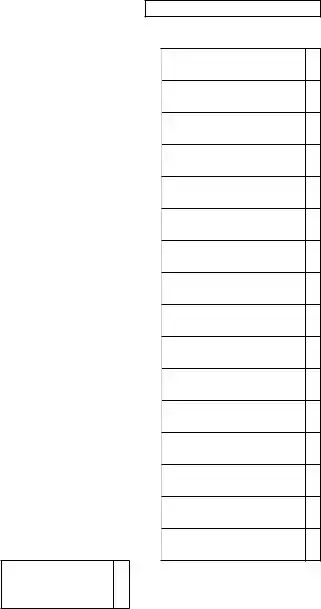

4568, Page 2 |

FEIN or TR Number |

25. |

Large Food Retailer Credit from Form 4573, line 31 |

25. |

26. |

26. |

|

27. |

Bottle Deposit Administration Credit from Form 4573, line 39 |

27. |

28. |

MEGA Federal Contract Credit from Form 4573, line 41 |

28. |

29. |

Biofuel Infrastructure Credit from Form 4573, line 44 |

29. |

30. |

Individual or Family Development Account Credit from Form 4573, line 50 |

30. |

31. |

Bonus Depreciation Credit from Form 4573, line 54 |

31. |

32. |

International Auto Show Credit from Form 4573, line 57 |

32. |

33. |

Brownield Redevelopment Credit from Form 4573, line 59 |

33. |

34. |

Private Equity Fund Credit from Form 4573, line 64 |

34. |

35. |

Film Job Training Credit from Form 4573, line 69 |

35. |

36. |

Film Infrastructure Credit from Form 4573, line 75 |

36. |

37. |

MEGA |

37. |

38. |

Anchor Company Payroll Credit from Form 4573, line 80 |

38. |

39. |

Anchor Company Taxable Value Credit from Form 4573, line 82 |

39. |

40. |

Total Nonrefundable Credits. Add lines 2, 4a, 4b, 5, 7, 8, 10, 11, 13, 14, 15, 17, 18, and 20 through 39. |

|

|

Enter total here and carry total to Form 4567, line 54, or Form 4590, line 27 |

40. |

41.Tax After Nonrefundable Credits. Subtract line 40 from line 1. If less than zero, enter zero. (This line must be equal to Form 4567, line 55,

or Form 4590, line 28.) |

41. |

00 |

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

+ 0000 2011 15 02 27 4

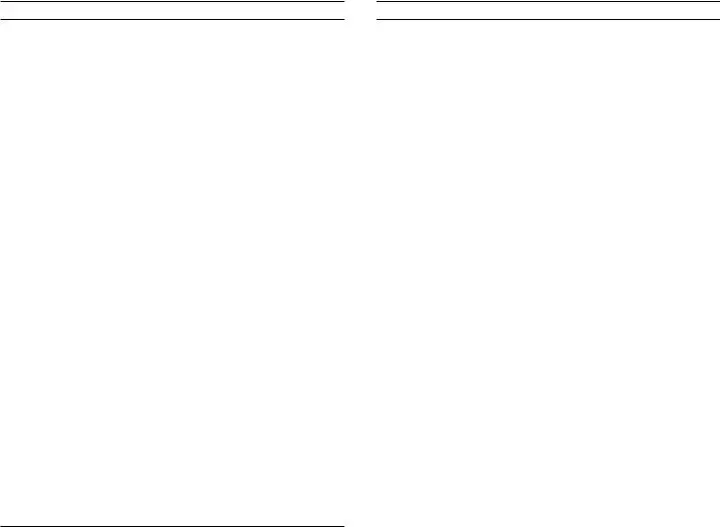

Instructions for Form 4568

Michigan Business Tax (MBT) Nonrefundable Credits Summary

Purpose

The purpose of this form is to determine a taxpayer’s tax liability after application of nonrefundable tax credits.

Form 4568 is intended to summarize all applicable nonrefundable credits. Speciic eligibility criteria, including varying credit carryforward life spans, apply to each of the

nonrefundable credits. For more details about each of the

credits, refer to the MBT Act or the instructions for the speciic

forms referenced on this form.

NOTE: This form may be used by both standard taxpayers and inancial institutions. Insurance companies use the

Miscellaneous Credits for Insurance Companies (Form 4596) to claim credits for which they may be eligible. Of the credits listed on this form, inancial institutions may only claim the following:

•Single Business Tax (SBT) Credit Carryforwards

•Compensation Credit

•Renaissance Zone Credit

•Historic Preservation Credit

•Individual or Family Development Account Credit

•Brownield Redevelopment Credit

•Film Infrastructure Credit.

The goal of arranging credits in this fashion is to minimize the need for taxpayers to go through all the available forms before deciding which ones may be applicable to them. Under the present arrangement, taxpayers are able to identify the forms pertaining to them, and eficiently prepare the tax return. Taxpayers should claim all credits for which they are eligible.

Special Instructions for Unitary Business Groups

Credits are earned and calculated on either an

statute.

be attributed an entity type based on the composition of its members.

Complete one Form 4568 for the group.

Further UBG instructions are provided on the forms where the

credits are calculated.

Lines not listed are explained on the form.

NAME AND ACCOUNT NUMBER: Enter name and account number as reported on page 1 of the applicable MBT annual return

(either the MBT Annual Return (Form 4567) for standard taxpayers or the MBT Annual Return for Financial Institutions (Form 4590)).

LINE 6: Although most of the entries on this form are credits that cause tax liability to decrease, if there is an entry on line 4b, subtracting that negative number will cause tax liability to

increase.

The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a

calculation error or an incorrect line entry.

LINE 9: The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a calculation error or an incorrect line entry.

LINE 16: Although most of the entries on this form are credits that cause tax liability to decrease, if there is a negative entry on line 15, subtracting that negative number will cause tax

liability to increase.

LINE 19: The total created by the calculations in this line cannot be less than zero. A total of less than zero is only possible through a calculation error or an incorrect line entry.

Include completed Form 4568 as part of the tax return iling.

Document Specs

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The Michigan 4568 form is designed to summarize a taxpayer's nonrefundable tax credits, thereby determining their tax liability after these credits are applied. |

| Governing Law | This form operates under the authority of Public Act 36 of 2007, which established the framework for the Michigan Business Tax. |

| Applicable Taxpayers | Both standard taxpayers and financial institutions can utilize Form 4568, although insurance companies must use a different form for their credits. |

| Credit Types | Form 4568 includes various nonrefundable credits, such as the Compensation Credit, Research and Development Credit, and Historic Preservation Credit. |

| Credit Calculation | Taxpayers must calculate their total nonrefundable credits by summing specific lines from the form, which then reduces their overall tax liability. |

| Negative Entries | In certain cases, negative entries on specific lines can increase tax liability, contrary to the general purpose of the credits. |

| Unitary Business Groups | Unitary Business Groups (UBGs) must complete a single Form 4568 for the group, applying credits on either an entity-specific or group basis as dictated by statutory provisions. |

| Filing Requirement | Completed Form 4568 must be included as part of the tax return filing, ensuring that all claimed credits are documented. |

| Line Instructions | Each line on Form 4568 has specific instructions, and taxpayers are advised to follow these carefully to avoid calculation errors. |

Fill out Common Templates

Michigan Department of Treasury Forms - Enables the Michigan Department of Treasury to accurately assess and collect real estate transfer taxes.

For those seeking to protect their healthcare choices, knowing how to use the crucial Medical Power of Attorney document is vital. This form empowers individuals to appoint trusted advocates to make medical decisions in times of incapacity, ensuring their preferences are respected when they cannot voice them.

Michigan Des 025 - By completing and submitting the DES-025, individuals take an essential step towards compliance with Michigan regulations.

Michigan 2023 Tax Forms - Filers are instructed to mail the completed form with remittance to the Michigan Department of Treasury, Special Taxes Division.