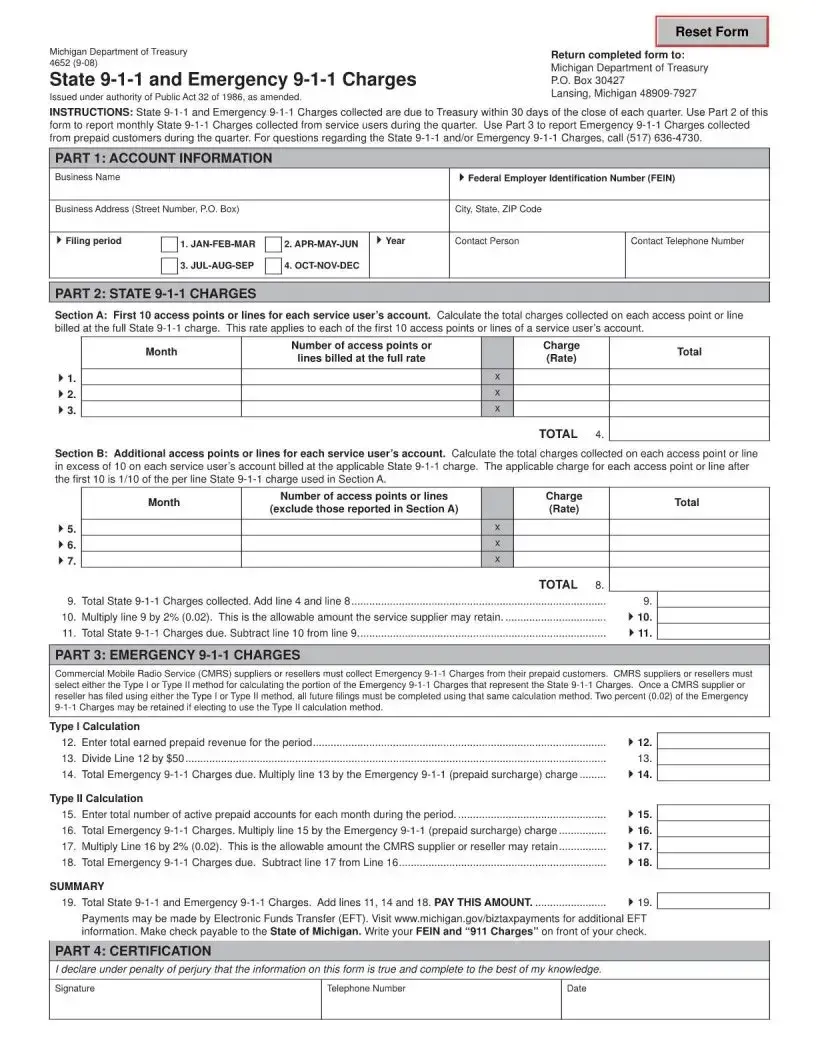

Free Michigan 4652 Template in PDF

The Michigan 4652 form is a crucial document for businesses that collect State 9-1-1 and Emergency 9-1-1 Charges. This form must be submitted to the Michigan Department of Treasury within 30 days after the end of each quarter. It serves to report the monthly State 9-1-1 Charges collected from service users and the Emergency 9-1-1 Charges collected from prepaid customers. Businesses must provide detailed account information, including their Federal Employer Identification Number and contact details. The form is divided into several sections, each designed to capture specific data related to the charges collected. Section A focuses on the first ten access points or lines billed at the full State 9-1-1 charge, while Section B accounts for additional lines beyond that threshold. The Emergency 9-1-1 Charges section requires Commercial Mobile Radio Service (CMRS) suppliers to choose between two calculation methods for reporting their charges. Accurate completion of this form is essential, as it impacts the financial obligations of service providers and ensures compliance with state regulations. Failure to submit the form correctly or on time could lead to penalties, making it imperative for businesses to understand and adhere to these requirements.

Form Example

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Michigan 4652 form is used to report State 9-1-1 and Emergency 9-1-1 Charges collected by service suppliers. |

| Governing Law | This form is issued under the authority of Public Act 32 of 1986, as amended. |

| Submission Deadline | Completed forms must be submitted to the Michigan Department of Treasury within 30 days after the end of each quarter. |

| Contact Information | For inquiries regarding the charges, individuals can call (517) 636-4730 for assistance. |

| Payment Methods | Payments can be made via Electronic Funds Transfer (EFT) or by check, with specific instructions provided on the form. |

Fill out Common Templates

Michigan 4363 - The section regarding the college the applicant plans to attend is crucial for determining the application of the grant towards the educational institution.

To better understand the significance of the document, refer to our detailed guide on the importance of the Notary Acknowledgement process in Maryland, available at the Notary Acknowledgement form requirements.

Weighmaster Michigan - The form includes important signatures from the dealer's agent, purchaser or lessor, and co-purchasers or co-lessors, finalizing the sale and registration process.