Free Michigan 4816 Template in PDF

The Michigan 4816 form is an essential document for local treasurers and county officials dealing with property tax matters, particularly in situations involving the denial of a Principal Residence Exemption (PRE). This form is specifically designed to request that the Michigan Department of Treasury bill a seller for additional taxes, interest, and penalties that arise when a PRE denial occurs after a property has been sold to a bona fide purchaser. To ensure accurate processing, it is crucial that the form is filled out completely and accompanied by necessary documentation, including the PRE denial notice and proof of property transfer. The form is divided into several parts, each requiring specific information such as property details, the nature of the PRE denial, and billing information for the seller. It is important to note that if the seller is not the same person who received the denial notice, additional explanations and documentation must be provided. The requirements outlined in this form reflect Michigan's tax laws, which state that sellers are responsible for any taxes associated with a PRE denial, especially when the property has changed hands. Understanding the nuances of this form can help prevent delays and inaccuracies in billing, thereby ensuring compliance with state regulations.

Form Example

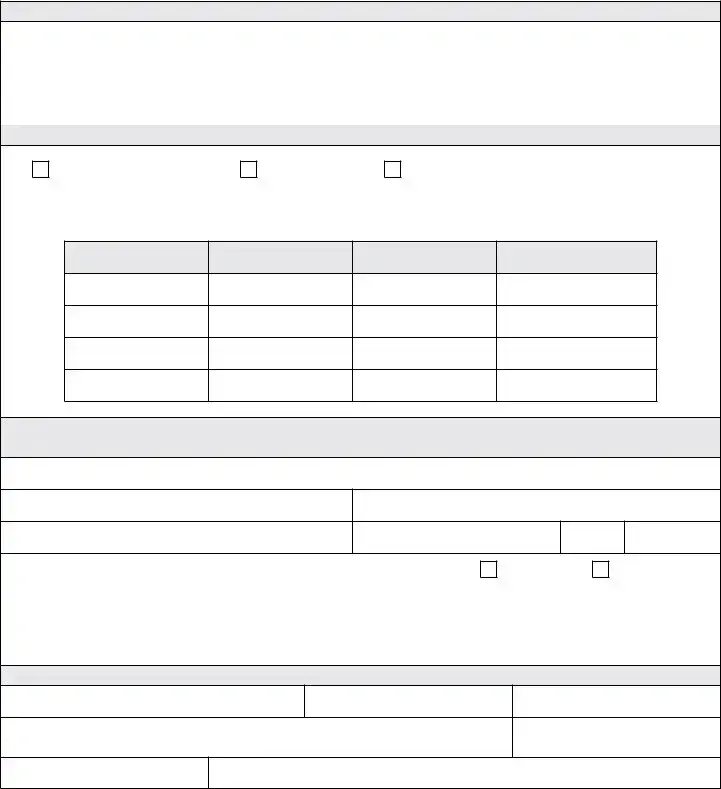

Michigan Department of Treasury 4816

Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial

Issued under authority of Public Act 206 of 1893.

Read the instructions before completing the form. This form and required documents must be submitted by the county or local treasurer

(whoever is in possession of the tax roll) when requesting that the Department of Treasury bill a seller for additional taxes, interest and penalties resulting from a PRE denial where the property has been transferred to a bona ide purchaser. Incomplete forms or a failure to

provide the required documentation will result in inaccurate billings or delays in processing. Use a separate form for each property tax identiication number.

PART 1: PROPERTY INFORMATION

Property Tax Identiication Number

Street Address |

|

|

County |

||

|

|

||||

Township or City Name (Check appropriate box, write in name) |

ZIP Code |

||||

|

|

Township |

|

City |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

PART 2: PRE DENIAL AND INTEREST INFORMATION — A copy of the denial notice must be attached.

Who denied the PRE?

Department of Treasury

County

Township/City Assessor

Date of Denial (MM/DD/YYYY) |

To whom was the denial issued? (Must not be the current owner.) |

|

|

In the table below, list the denied years to be billed and the corresponding tax information.

DENIAL YEAR

SchOOL OPERATINg

MILLAgE RATE

TAxABLE vALuE

DuE DATE

(Summer, Winter, combined)

PART 3: BILLINg INFORMATION — A copy of the deed, land contract or other legally executed document transferring the property from the seller to the bona ide purchaser must be attached.

First and last name of seller(s) to be billed. (Must not be the current owner. See instructions for details.)

Company Name (if applicable)

Federal Employer Identiication Number (FEIN)

Current Mailing Address

City

State

ZIP Code

Is the seller(s) to be billed the same person(s) or entity that was issued the denial notice and listed in Part 2?

Yes

No

If answered “no,” explain here and attach any supporting documents. (It is a rare exception for the two to be different. See instructions for details.)

PART 4: cOuNTY OR LOcAL uNIT cONTAcT INFORMATION

Name of Person Who Prepared Form (Print or Type)

Title

Name of County or Local Unit

Preparer’s Signature

Date

Telephone Number

Mail completed form and supporting documentation to: Michigan Department of Treasury, PRE Unit, P.O. Box 30440, Lansing, MI 48909.

4816, Page 2

Instructions for Form 4816

Request to Bill Seller Following a Principal Residence Exemption (PRE) Denial

This form must be submitted by the county or local treasurer (whoever is in possession of the tax roll) when requesting that the

Department of Treasury (Department) bill a seller for additional taxes, interest and penalties resulting from a PRE denial where the property has been transferred to a bona ide purchaser. Speciically, Subsections 6, 8 and 11 of Michigan Compiled Laws 211.7cc state that “if the property has been transferred to a bona ide purchaser before additional taxes were billed to the seller as a result of the

denial of a claim for exemption, the taxes, interest, and penalties shall not be a lien on the property and shall not be billed to the bona

ide purchaser ….” The local tax collecting unit in possession of the tax roll then notiies the Department, which “shall then assess the

owner who claimed the exemption under this section for the tax, interest, and penalties accruing as a result of the denial of the claim for exemption ….” In other words, the seller (the person denied) is responsible for all additional taxes, interest and penalties due for

the years up to and including the year of the sale if the purchaser is a “bona ide purchaser.” The PRE is not removed in these bona ide purchaser situations.

A “bona ide purchaser” is one who purchases in good faith for valuable consideration. Therefore, a person who receives property

through an inheritance, foreclosure or one who receives property through a quit claim without valuable consideration, would not qualify as a bona ide purchaser. If the new owner is not a bona ide purchaser, the taxes are added back to the tax roll and the purchaser is responsible for the additional taxes, interest and penalties which become a lien on the property.

There are rare situations, however, where the person(s) or entity that was denied the PRE lost the property in a foreclosure or some other circumstance to an “acquiring entity,” which then subsequently sold the property to a bona ide purchaser. In these situations, the “acquiring entity” that sold the property would be responsible for the additional taxes, interest and penalties although the denial notice was issued to the prior owner. In these unusual circumstances, since the property was not acquired for valuable consideration, the transfer to the “acquiring entity” is not considered a bona ide purchase. As a result, the “acquiring entity” is responsible for the additional taxes, interest and penalties. If this rare situation occurs, explain in Part 3 the circumstances involved and attach any supporting documents. If the “acquiring entity” has not sold the property to a bona ide purchaser, the billing of additional taxes, interest and penalties must occur at the county or local unit level (whichever is in possession of the tax roll) since the transfer was not a bona ide purchase.

In order for the Department to process a request to bill the seller (the person or entity who was issued the denial notice) for additional taxes, interest and penalties in a bona ide purchaser situation, this form must be completed with the required documents attached. Upon

review of the completed form and supporting documents, the Department will process and issue a bill, which will include additional taxes and applicable interest and penalties, to the person(s) or entity listed in Part 3.

PART 1: PROPERTY INFORMATION

All of the information in Part 1 must be provided to the Department to process the request. Use a separate form for each property tax identiication number.

PART 2: PRE DENIAL INFORMATION

A copy of the PRE denial notice relating to the property in Part 1 must be submitted with this form. The date of the denial notice must be listed on the form along with the person(s) or entity that issued the denial notice. If the denial notice was issued to the current owner of

the property, the billing of additional taxes, interest and penalties must occur at the county or local unit level (whichever is in possession of the tax roll) and does not qualify as a bona ide purchaser situation. In addition, if the purchaser is not a “bona ide purchaser,” as described earlier, the billing also must occur at the county or local level.

For each year the PRE was denied, requiring the Department to bill the seller, list the school operating millage rate, taxable value, and the due date of the school operating taxes (summer, winter, or combined summer/winter).

PART 3: BILLINg INFORMATION

A copy of the deed, land contract or other legally executed document transferring the property from the seller to the bona ide purchaser must be submitted with this form. Each seller to be billed must be listed including a current mailing address (if the mailing address is available). If the seller is a company, the complete company name, address, and Federal Employer Identiication Number (FEIN), if available, must be provided.

PART 4: cOuNTY OR LOcAL uNIT cONTAcT INFORMATION

Complete the contact information in the event the Department has a question or needs clariication. The completed form and supporting documents must be mailed to the address at the bottom of the form. Failure to provide complete information or adequate supporting documentation will result in delays in processing.

If you have any questions, call the PRE Unit at (517)

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used to request billing for additional taxes, interest, and penalties after a Principal Residence Exemption (PRE) denial. |

| Governing Law | The form is issued under Public Act 206 of 1893 and is governed by Michigan Compiled Laws 211.7cc. |

| Submission Requirement | County or local treasurers must submit this form when the property has been transferred to a bona fide purchaser. |

| Documentation Needed | A copy of the PRE denial notice and the deed or contract transferring the property must be attached. |

| Form Completeness | Incomplete forms or missing documents can lead to delays or inaccurate billings. |

| Separate Forms | A separate form must be completed for each property tax identification number. |

| Bona Fide Purchaser Definition | A bona fide purchaser buys property in good faith for valuable consideration. Inheritance or foreclosure does not qualify. |

| Contact Information | Contact details of the preparer must be provided for any follow-up questions from the Department. |

Fill out Common Templates

Acceptance of Trustee Form Michigan - Contains guidelines for legally handling disputes over the authenticity or interpretation of multiple wills, ensuring the decedent's true intentions are honored.

For those interested in using the form effectively, it is important to review the procedures and requirements outlined in the Illinois PDF Forms, ensuring that all legal obligations are met during the eviction process.

Mi Where's My Refund - The form includes detailed instructions for additions and subtractions to income.