Free Michigan 5107 Template in PDF

The Michigan 5107 form is a critical document for disabled veterans seeking property tax exemptions in the state. Designed under Public Act 161 of 2013, this affidavit allows qualifying individuals—either the disabled veteran or their unremarried surviving spouse—to apply for an exemption on their homestead property taxes. To be eligible, the applicant must have been discharged from the armed forces under honorable conditions and must own and occupy the property as their primary residence. The form requires specific information, including the owner’s details, property address, and the legal designee's information if applicable. It also includes an acknowledgment section where applicants affirm their eligibility based on various criteria, such as being permanently and totally disabled as determined by the U.S. Department of Veterans Affairs. This form must be submitted annually to the local assessing officer after December 31 and before the designated deadline in December. Completing the Michigan 5107 form accurately is essential for ensuring that eligible veterans and their families receive the financial relief they deserve.

Form Example

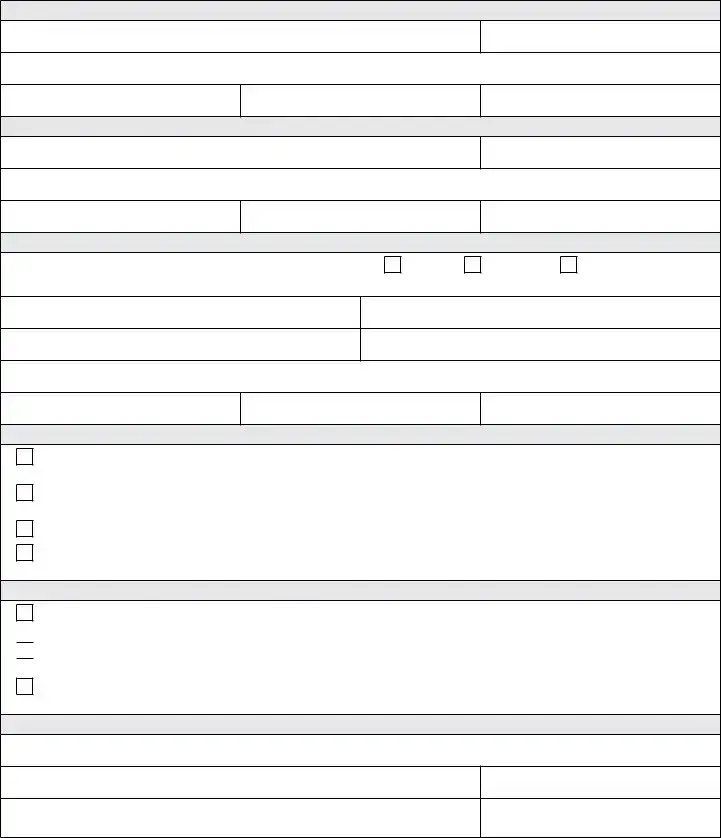

Michigan Department of Treasury 5107

State Tax Commission Afidavit for Disabled Veterans Exemption

Issued under authority of Public Act 161 of 2013, MCL 211.7b. Filing is mandatory.

Instructions: This form is to be used to apply for an exemption of property taxes under MCL 211.7b, for real property used and owned as a homestead by a disabled veteran who was discharged from the armed forces of the United States under honorable conditions or his or her unremarried surviving spouse.

The property owner, or his or her legal designee, must annually ile the Afidavit with the supervisor or assessing oficer after December 31 and before the

Tuesday following the second Monday in December.

OWNER INFORMATION (Enter information for the disabled veteran or unremarried surviving spouse)

Owner’s Name

Owner’s Telephone Number

Owner’s Mailing Address

City

State

ZIP Code

LEGAL DESIGNEE INFORMATION (Complete if applicable)

Legal Designee Name

Daytime Telephone Number

Mailing Address

City

State

ZIP Code

HOMESTEAD PROPERTY INFORMATION (Enter information for the property in which the exemption is being claimed)

City, Township or Village (Check the appropriate box and provide the name)

City

Township

Village

County

Name of the Local School District

Parcel Identiication Number

Date the Property was Acquired (MM/DD/YYYY)

Homestead Property Address

City

State

ZIP Code

ACKNOWLEDGEMENT (Check all boxes that apply)

I am a disabled veteran, or the legal designee of the disabled veteran, who was discharged under honorable conditions from the armed forces of the United States of America with a service connected disability.

I am the unremarried surviving spouse, or the legal designee of the unremarried surviving spouse, of a disabled veteran who was discharged under honorable conditions from the armed forces of the United States of America with a service connected disability.

I am a Michigan resident.

I own the property in which the exemption is being claimed and it is used as my homestead. Homestead is generally deined as any dwelling with

its land and buildings where a family makes its home.

AFFIRMATION OF ELIGIBILITY (Check the appropriate box and provide a copy of the required documentation)

The disabled veteran has been determined by the United States Department of Veterans Affairs to be permanently and totally disabled as a result

of military service and entitled to veterans’ beneits at the 100% rate (must attach a copy of the letter from the U.S. Department of Veterans Affairs).

The disabled veteran is receiving or has received pecuniary assistance due to disability for specially adapted housing (must attach a copy of the certiicate from the U.S. Department of Veterans Affairs).

The disabled veteran is receiving or has received pecuniary assistance due to disability for specially adapted housing (must attach a copy of the certiicate from the U.S. Department of Veterans Affairs).

The veteran has been rated by the United States Department of Veterans Affairs as individually unemployable (must attach a copy of the letter from the U.S. Department of Veterans Affairs).

CERTIFICATION

I hereby certify to the best of my knowledge that the information provided in this Afidavit is true and I am eligible to receive the disabled veteran’s exemption from property taxes pursuant to Michigan Compiled Law, Section 211.7b.

Printed Name of Owner or Legal Designee

Title of Signatory

Signature of Owner or Legal Designee

Date

DESIGNEE MUST ATTACH LETTER OF AUTHORITY

Document Specs

| Fact Name | Details |

|---|---|

| Purpose | The Michigan 5107 form is used to apply for property tax exemption for disabled veterans or their unremarried surviving spouses. |

| Governing Law | This form is issued under the authority of Public Act 161 of 2013, MCL 211.7b. |

| Eligibility | Eligible applicants include disabled veterans discharged under honorable conditions and their unremarried surviving spouses. |

| Filing Deadline | The affidavit must be filed annually after December 31 and before the Tuesday following the second Monday in December. |

| Owner Information | Applicants must provide personal information including name, telephone number, and mailing address. |

| Legal Designee | If applicable, the form allows for a legal designee to file on behalf of the disabled veteran or surviving spouse. |

| Homestead Definition | Homestead is defined as the dwelling and land where the family resides, which is eligible for the exemption. |

| Certification | The applicant must certify that the information provided is true and that they are eligible for the exemption under MCL 211.7b. |

Fill out Common Templates

Michigan Income Tax Forms - Form 151 facilitates legal and formal communication between the state and appointed representatives, safeguarding taxpayer rights and confidentiality.

Michigan Secretary of State Affidavit Form - Michigan residents can use form BDVR-153 to obtain detailed driving records for a variety of purposes.

For those looking to facilitate the vehicle transfer process in Maryland, the essential Motor Vehicle Bill of Sale form can provide comprehensive legal assurance and clarity. To access and complete this vital document, please visit our resource at your guide to the Motor Vehicle Bill of Sale.

Principal of Residence - Property owners must disclose any other Michigan principal residence exemptions they've claimed or rescinded.