Free Michigan 5156 Template in PDF

The Michigan 5156 form, officially titled the Request for Tax Clearance Application, is a crucial document for businesses navigating the complexities of closing or selling their operations. This form is issued by the Michigan Department of Treasury under the authority of Public Act 228 of 1975 and serves multiple purposes depending on the specific circumstances of the business. Whether a business is being sold, closing its doors, or has already completed a sale, the form requires different sections to be filled out. For instance, all applicants must complete Part 1, which gathers general information about the business, including its current and previous names, addresses, and identification numbers. If the business is incorporated, Part 2 must be completed to address corporate dissolution or withdrawal. For those who have sold their business or assets, Part 3 is essential for detailing the sale and any escrow arrangements. Finally, Part 4 includes a certification and authorization section, ensuring that the information provided is accurate and allowing for the disclosure of tax clearance information. Understanding the nuances of this form is vital for business owners to ensure compliance and a smooth transition during these significant changes.

Form Example

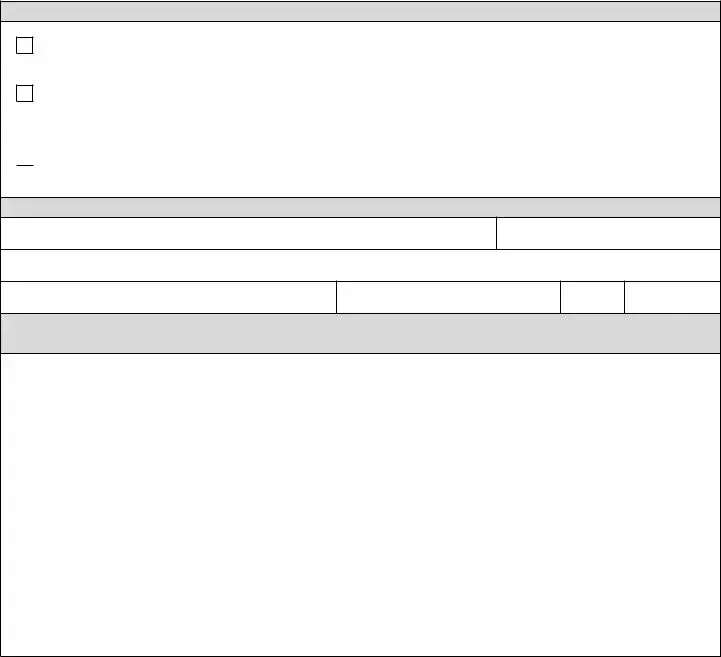

Michigan Department of Treasury 5156 (Rev.

Request for Tax Clearance Application

Issued under authority of Public Act 228 of 1975, as amended.

ReAson foR The RequesT

I am selling my business or business assets. l Complete Part 1 and Part 4 ONLY

I am closing my business and my business is registered as a corporation with the Michigan Department of Licensing and Regulatory Affairs.

l Complete Part 1, Part 2, and Part 4 ONLY

I have completed the sale of my business or business assets and require a tax clearance certiicate. l Complete Part 1, Part 3, and Part 4 ONLY

I have completed the sale of my business or business assets and require a tax clearance certiicate. l Complete Part 1, Part 3, and Part 4 ONLY

PART 1: GeneRAl InfoRmATIon — To be completed by ALL applicants.

Current Business or Corporation Name

FEIN or TR Number

Previous Business or Corporation Name

Address

City

State

ZIP Code

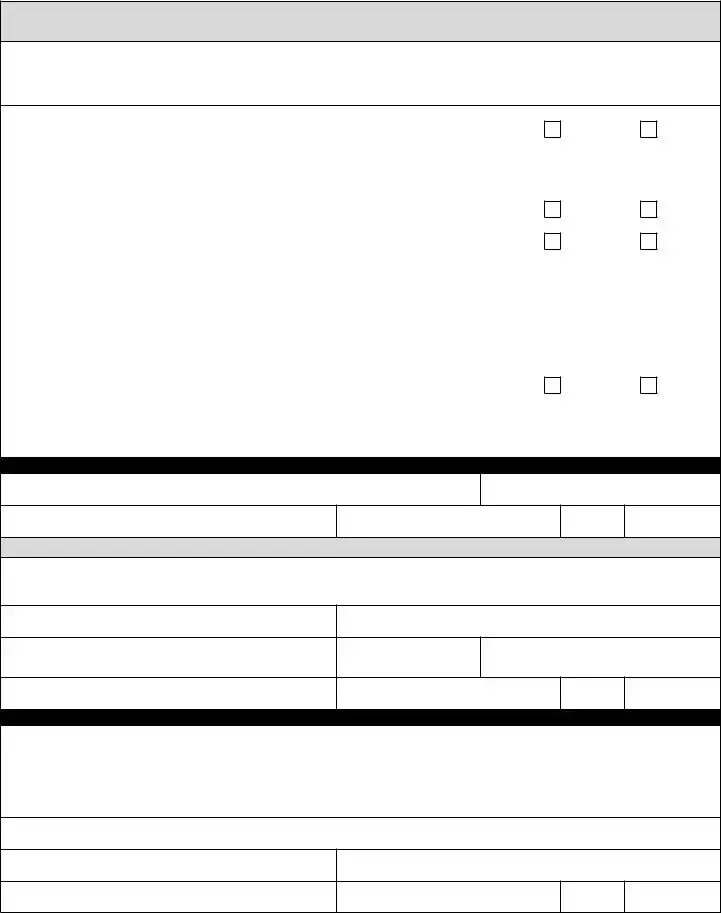

PART 2: CoRPoRATe DIssoluTIon oR WIThDRAWAl — To be completed by any business entity incorporated through the Michigan Department of Licensing and Regulatory Affairs (LARA).

noTe: The date that the business is actually discontinued (below) should relect the date on the Form 163 Notice of Change or Discontinuance submitted to the Michigan Business Tax Registration Unit. If this form has not been submitted, please complete and attach with this request. If the business and its FEIN number were not registered with the Michigan Department of Treasury, please submit the last four years of Federal Business Tax Returns in place of the Form 163.

Corporate ID Number Assigned by LARA |

Date Incorporated with the State through LARA |

Date Business Actually Discontinued in Michigan |

|

|

|

If this corporation had no tax liability or was not required to register with the Michigan Department of Treasury, provide a detailed explanation in the space below. Substantiate with attachments:

Continue and sign on Page 2

Form 5156, Page 2

PART 3: sAle of BusIness oR AsseTs — To be completed by any business (all types) that has sold all or part of the business prior to submitting this application.

ImPoRTAnT: This is a request by any business entity that has sold most of its assets, but the business shell will remain in place to continue iling tax returns (when due) until the business later determines whether it will ile a Certiicate of

Dissolution with the LARA Corporation Division.

Does the business operate under a trade name? |

Yes |

No |

|

|

|

|

|

||

|

|

|

|

|

If yes, list the name it is doing business as |

|

|

|

|

Will you continue business activity after clearance under this FEIN or TR number? |

Yes |

No |

|

|

If no, have you submitted a Notice of Change or Discontinuance (Form 163)? |

Yes |

No |

|

|

|

|

|

||

If yes, date of discontinuance reported on Form 163 |

|

|

|

|

|

|

|

||

If no, attach a completed Form 163 with this request. |

|

|

|

|

.........................................Date of sale of business or business assets to another entity |

|

|

|

|

Is money being held in escrow pending receipt of a tax clearance? |

Yes |

No |

|

|

If yes, how much is held in escrow? |

|

|

|

|

|

|

|

||

|

|

|

|

|

PuRChAseR InfoRmATIon |

|

|

|

|

Purchaser Business Name

Purchaser FEIN

Purchaser Address

City

State

ZIP Code

PART 4: CeRTIfICATIon AnD AuThoRIzATIon foR DIsClosuRe of InfoRmATIon

I declare under penalty of perjury that I am the owner, oficer, or member of the business for which tax clearance is requested and that the information entered is true.

Name (Print or Type)

Title

Signature

Date

Telephone Number

Address

City

State

ZIP Code

AuThoRIzATIon foR DIsClosuRe of TAx CleARAnCe InfoRmATIon (This is not a required section)

use this section to designate a third party to receive all tax clearance information for the business listed in Part 1.

The above signed authorizes the Michigan Department of Treasury, Tax Clearance Section, to release any and all tax information and outstanding balances due for the purpose of tax clearance to the individual(s) listed below. This authorization does not include signature power. This authorization is only valid for 90 days from the date of the signature above.

Name

Telephone Number

Fax Number

Address

City

State

ZIP Code

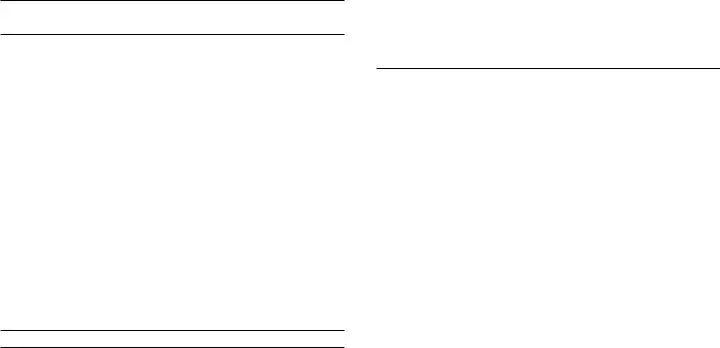

Instructions for form 5156,

Request for Tax Clearance

Part 1: General Information – All fIelDs In ThIs seCTIon musT Be ComPleTeD

NOTE: If you are selling a business but the sale has not occurred, the Michigan Department of Treasury (Treasury) will provide known or estimated tax liability for the purpose of

establishing a tax escrow. Once the sale is complete, submit a new request completing Part 1 and Part 3 to obtain a certiicate

for the release of the escrowed funds.

Current Business or Corporation Name: Enter the

legal business/corporation name. If the business is a sole proprietorship, enter the owner’s name here, with the last name

irst.

Federal Employer Identiication Number (FEIN) or Treasury Issued Account Number (TR): Enter the business’

Business Street Address/City/State/ZIP Code: Enter the

physical business address. (A PO Box is not acceptable in this ield.)

Part 2: Corporate Dissolution or Withdrawal

Complete this section if you are dissolving a domestic (Michigan) corporation or if you have a foreign corporation (incorporated outside Michigan) that is withdrawing from

Michigan. A corporation is any business entity that has iled

and incorporated with the Michigan Department of Licensing and Regulatory Affairs (LARA).

NOTE: A Tax Clearance Certiicate must be requested from

Treasury within 60 days of dissolution or withdrawal of business from Michigan.

Corporate Identiication Number: Enter the business’

Date Business Discontinued in Michigan: Enter the date

your business ceased operations in Michigan. This date should relect the date entered on the Notice of Change or

Discontinuance (Form 163). If you have failed to complete and submit Form 163 to the Registration Unit, you must complete and remit Form 163 with this application. In the event your business’ FEIN was never registered with Treasury, you must include the last four years of Federal Returns for the business in place of Form 163.

Date Incorporated with the State of Michigan through

LARA: Enter the date of incorporation. For additional

information, go to LARA’s Web site: www.michigan.gov/lara.

If the corporation had no tax liability or was not required to register with Treasury, provide a detailed explanation. In rare cases, a corporation may not have had any tax liability or may not have registered for taxes with the State of Michigan. If your business falls into this category, use the space provided

to explain why no taxes were due and registration was not required. Include dates of operation and the nature of the business. You must include attachments with your application to substantiate your position in order for it to be fully reviewed.

Part 3: sale of Business or Assets has occurred

Complete this section if your business or any of the assets have been sold.

NOTE: You must continue to ile all returns by their due date until you elect to ile a dissolution or withdrawal. A Tax Clearance Certiicate for Sale of Business and/or Business

Assets is required when a bulk sale or transfer is made under

the Uniform Commercial Code. A Tax Clearance Certiicate

for Sale of Business and/or Business Assets is granted after Treasury determines that all Sales, Use, Income Withholding, Cigarette, Motor Fuel, Single Business, Michigan Business,

and Corporate Income taxes have been paid for the period of operation. When a Tax Clearance Certiicate for Sale of

Business and/or Business Assets is issued, money held in escrow is released and the purchaser is relieved of successor liability. The seller agrees to keep all books and records of the business until they are released by Treasury. The seller is liable

for all taxes due from the operation of the business during the time speciied by Treasury.

Does the business operate under a trade name? If your business operates under any name other than the legal corporation name, check (with an “X”) yes in the appropriate box. On the next line, enter the trade name, assumed name, or doing business as name. If your business only operates under its legal corporation name, check (with an “X”) no.

Are you continuing business activity after clearance under this FEIN or TR number? If you plan to continue

to operate your business within the State of Michigan, check (with an “X”) yes in the appropriate box. If you do not plan to continue operating, check (with an “X”) no. If you have already

submitted a Form 163 to the Registration Unit, enter the discontinuance date listed on that form. If you have yet to ile

Form 163 with the Registration Unit, attach a completed Form 163 with this application.

NOTE: The following items should ONLY be illed out if the

sale has occurred, not before.

Date of Sale of Business or Business Assets to Another

Entity. Enter the date all or part of the business was sold.

Is money being held in escrow pending receipt of a Tax Clearance Certiicate? If money is being held in escrow from

the sale, check (with an “X”) yes and enter the amount being held.

Business Name, Street Address, and FEIN of Purchaser.

Enter purchaser’s legal name, address, and FEIN.

Part 4: Certiication and Authorization for Disclosure of Tax Clearance Information

NOTE: All ields directly under the Certiication must be completed. If authorizing the disclosure of information, all ields in that section must be completed as well.

This section must be completed for all requests. All requests must be submitted by an owner, oficer, or member of the business. By completing the Certiication, you are declaring

under penalty of perjury that all information entered is true.

Complete this section with your printed name, title, signature, daytime phone number, contact address, and the date in which the application was completed.

submitting form 5156

Complete and mail this form to:

Michigan Department of Treasury

Tax Clearance Section

P.O. Box 30778

Lansing, MI 48909

For additional information, call (517)

Document Specs

| Fact Name | Details |

|---|---|

| Purpose of Form | The Michigan 5156 form is used to request a tax clearance certificate when selling a business or business assets, closing a business, or after the sale has been completed. |

| Governing Law | This form is issued under the authority of Public Act 228 of 1975, as amended, which governs tax clearance requests in Michigan. |

| Completion Requirements | Depending on the reason for the request, applicants must complete specific parts of the form: Part 1 is mandatory for all, while Parts 2 or 3 are required based on the business status. |

| Submission Instructions | Completed forms should be mailed to the Michigan Department of Treasury, Tax Clearance Section, at P.O. Box 30778, Lansing, MI 48909. |

Fill out Common Templates

2022 Michigan Tax Forms - It includes instructions for taxpayers who have received their income unevenly throughout the year and opt to annualize their income.

Immunization Records Michigan - Changing your address? The form asks for both old and new addresses to ensure records are sent to the right place.

When engaging in the transaction of a vehicle, utilizing a reliable complete Maryland Motor Vehicle Bill of Sale form is vital for ensuring that the process is documented correctly and legally binding.

Michigan Bonded Title - This form serves as a financial guarantee to the Michigan Department of Licensing and Regulatory Affairs for the benefit of any interested party.