Free Michigan 632 Template in PDF

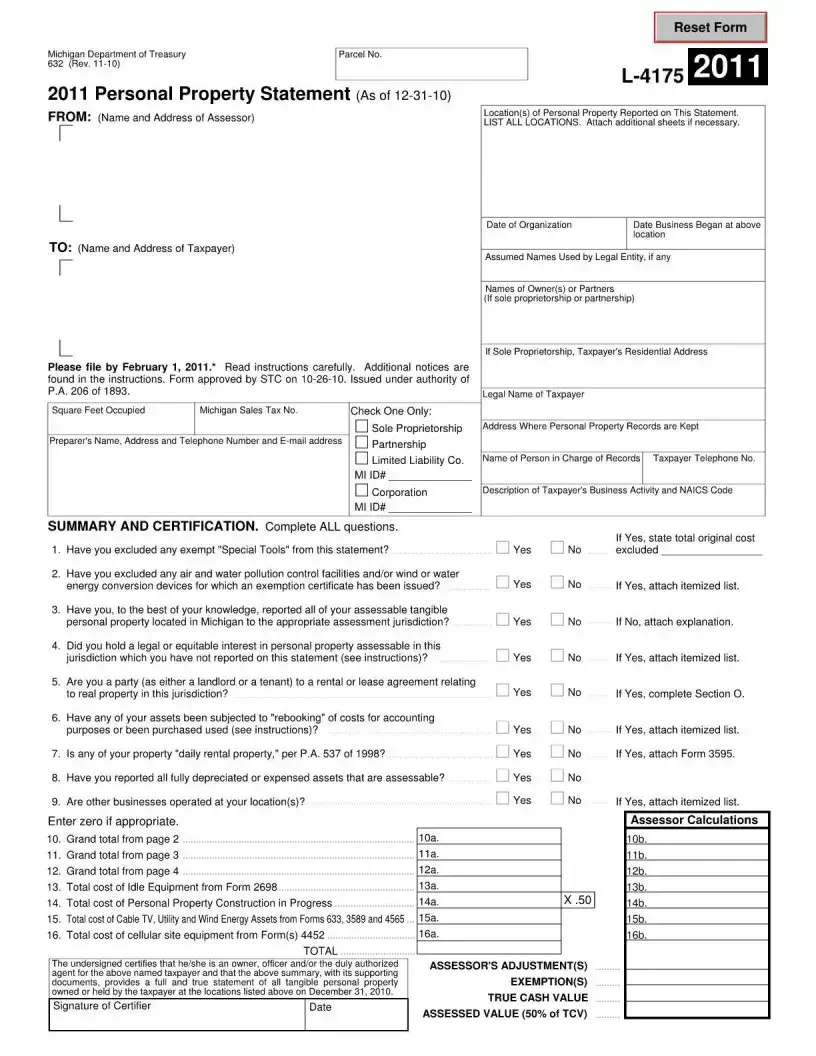

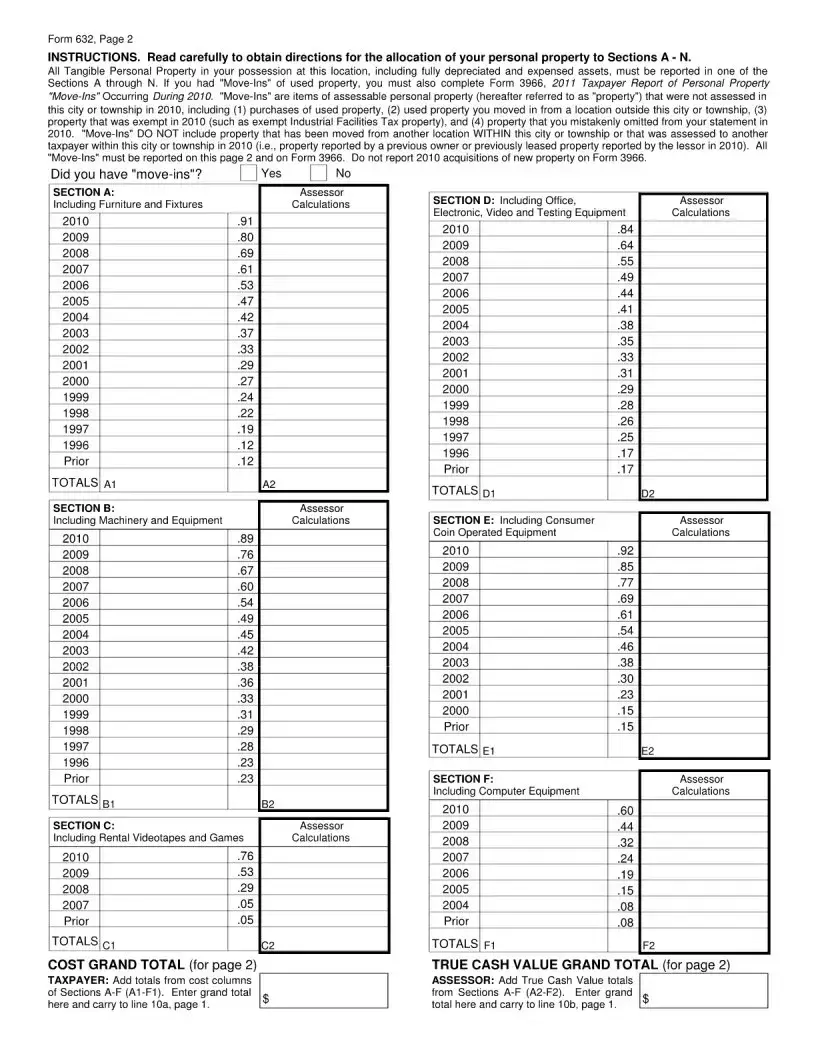

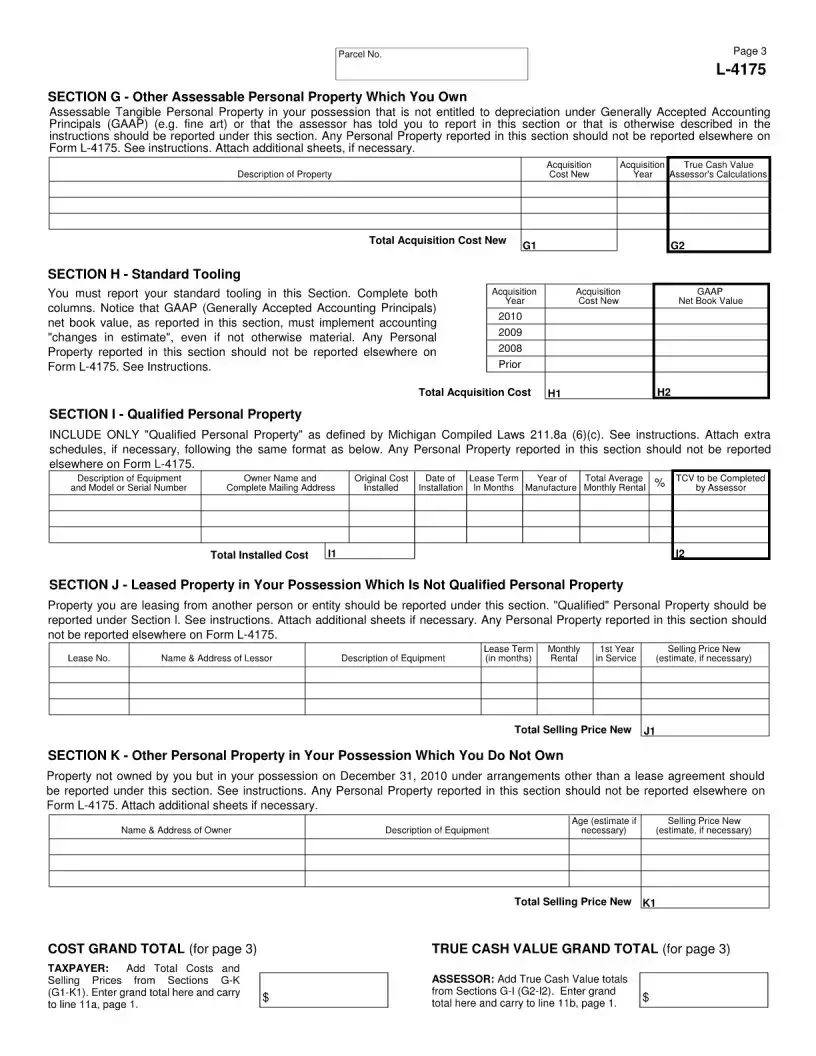

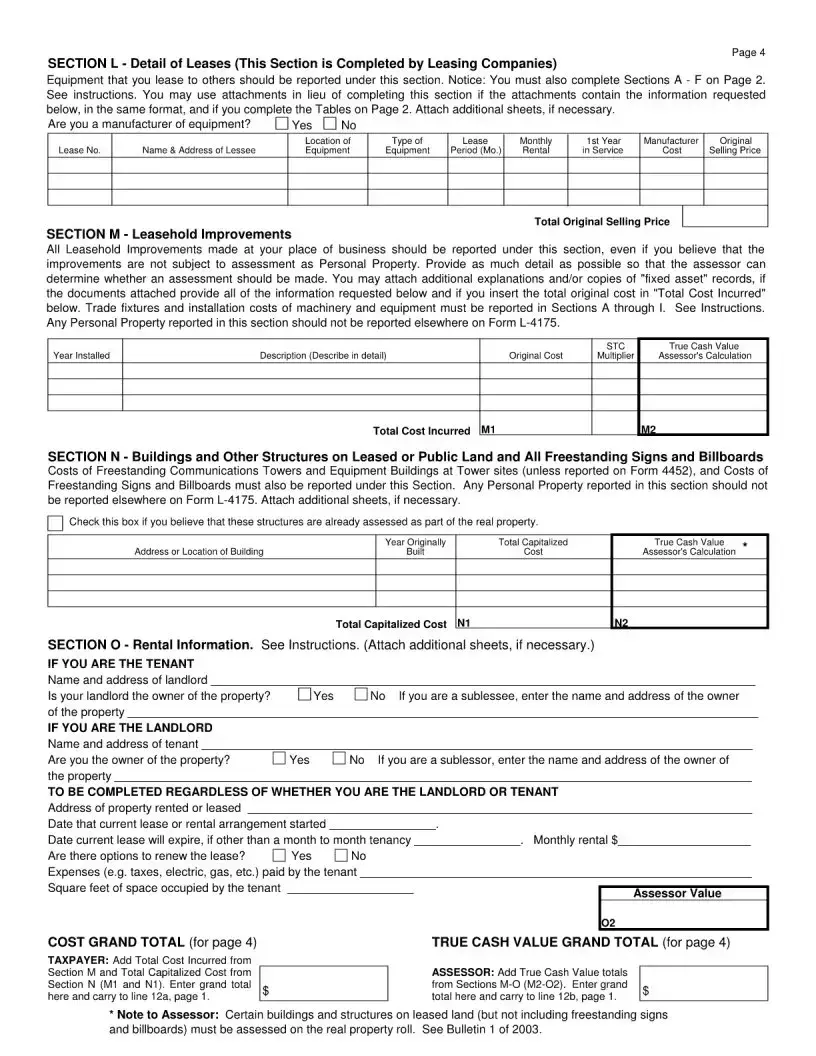

The Michigan 632 form, also known as the Personal Property Statement, plays a crucial role in the assessment of tangible personal property for tax purposes. This form must be completed by businesses and individuals who own personal property in Michigan, providing detailed information about the property they possess as of December 31 each year. Key sections of the form require taxpayers to list their business activities, the locations of their personal property, and any assumed names under which they operate. Taxpayers must also disclose whether they have excluded any exempt items, such as special tools or pollution control facilities, and confirm that they have reported all assessable personal property accurately. The form includes a summary and certification section where the taxpayer certifies the accuracy of the information provided. Additionally, it outlines the obligations for reporting various types of property, including leased items and equipment not owned by the taxpayer. Filing is mandatory by February 1, and failure to comply can lead to penalties. Understanding the nuances of the Michigan 632 form is essential for ensuring compliance and avoiding potential tax liabilities.

Form Example

Document Specs

| Fact Name | Details |

|---|---|

| Purpose | The Michigan 632 form is used to report personal property owned by businesses as of December 31 each year. |

| Filing Deadline | Taxpayers must file the form by February 1 of the following year. |

| Governing Law | This form is issued under the authority of Public Act 206 of 1893. |

| Exemptions | Taxpayers can exclude certain exempt items, such as special tools and pollution control facilities, from their report. |

| Required Information | The form requires details about the taxpayer, including business activity, property locations, and ownership structure. |

| Assessor's Role | Assessors review the submitted forms to determine the taxable value of the reported personal property. |

Fill out Common Templates

Michigan Disabled Veteran Benefits - Includes sections for owner information, legal designee information, and homestead property specifics.

For those navigating the process, a comprehensive guide to the Mobile Home Bill of Sale is invaluable. This document lays out the steps necessary to ensure a proper and legal transfer of ownership. For further assistance, visit this page on Mobile Home Bill of Sale requirements.

Land Contract Agreement Template - Provides a clear and legally binding record of the sale and purchase agreement for land in Michigan.

Unemployment Login Michigan - Its completion is voluntary but essential for a thorough unemployment claim review.