Free Michigan 777 Template in PDF

The Michigan 777 form, also known as the Resident Credit for Tax Imposed by a Canadian Province, is a crucial document for individuals who have income subject to taxation in both Michigan and Canada. This form, issued by the Michigan Department of Treasury, allows residents to claim a credit for taxes paid to Canadian provinces, thereby mitigating the potential for double taxation. Filing this form is voluntary and pertains to tax year calculations under Public Act 281 of 1967. The form consists of several parts that guide taxpayers through the process of converting Canadian wages and taxes into U.S. currency, computing Michigan tax liabilities, and determining the allowable credit for taxes paid to Canadian provinces. Key components include the conversion of Canadian income, adjustments for U.S. tax calculations, and specific calculations to arrive at the credit amount. Completing the Michigan 777 form accurately is essential for ensuring that taxpayers receive the appropriate credits and do not overpay their tax obligations. It requires careful attention to detail, as various lines need to be filled out based on the taxpayer's specific financial situation, including income from Canadian sources and applicable deductions.

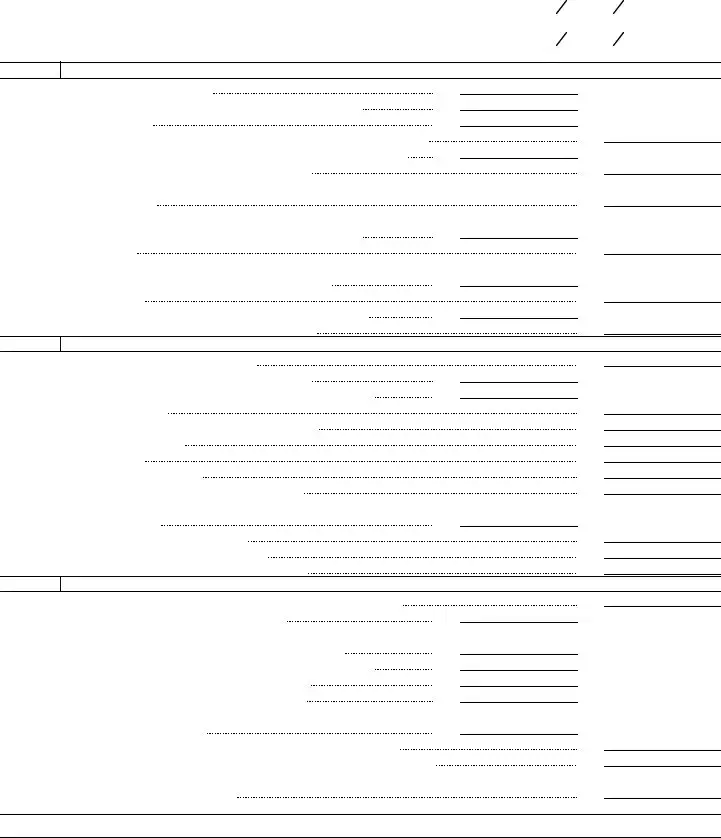

Form Example

Michigan Department of Treasury, ITD

777 (Rev.

RESIDENT CREDIT FOR TAX IMPOSED |

|

|

|

BY A CANADIAN PROVINCE |

For Tax Year |

Issued under P.A. 281 of 1967. Filing is voluntary. |

2000 |

|

|

Name(s) as shown on your |

Social Security Number |

|

|

Address, City, State and ZIP |

Spouse's Social Security Number |

|

|

PART 1

CONVERSION OF CANADIAN WAGES AND TAXES TO UNITED STATES CURRENCY

1. |

Canadian income taxed by Michigan |

1. |

|

|

|

2. |

Fringe benefits included in Box 14 of the |

2. |

|

|

|

3. |

Subtract line 2 from line 1 |

3. |

|

|

|

4. |

Multiply line 3 by the annualized conversion rate of 67.40% (.6740) (see inst.) |

|

5. |

Total Canadian income from line 150 of your Canadian income tax return |

5. |

|

|

6.Multiply line 5 by the conversion rate of 67.40% (.6740)

7.Divide line 4 by line 6 (percentage of Canadian income taxed by Michigan to total Canadian income)

8.Multiply the Canadian federal tax (line 420 of Canadian return)

|

$__________________by the conversion rate of 67.40% (.6740) |

8. |

|

|

|

9. |

Multiply line 8 by line 7 |

|

10. |

Multiply the provincial tax (line 428 of Canadian return) |

|

|

$_____________ by the conversion rate of 67.40% (.6740) |

10. |

11. |

Multiply line 10 by line 7 |

|

12. |

Contribution to Canadian Pension Plan from |

12. |

13. |

Multiply line 12 by the conversion rate of 67.40% (.6740) |

|

4.

6.

7.%

11.

13.

PART 2 COMPUTATION OF MICHIGAN TAX

14.Adjusted gross income from

15.Canadian income taxed by Michigan from line 4, above

16.U.S. adjustments to Canadian wages (from U.S. 1040 lines 23

17.Subtract line 16 from line 15

18.Subtract line 17 from line 14 for Michigan source income

19.Additions from

20.Add lines 17, 18 and 19

21.Subtractions from

22.Subtract line 21 from line 20 for income subject to tax

23.Divide line 17 by line 22 for percentage of Canadian income to

total income subject to tax

24.Exemption allowance from

25.Subtract line 24 from line 22 for taxable income

26.Multiply line 25 by the Michigan tax rate of 4.2% (.042)

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.%

24.

25.

26.

PART 3 ALLOWABLE CREDIT FOR TAX PAID CANADIAN PROVINCE

27. |

Multiply line 26 by line 23 for Michigan tax on Canadian province income |

|

|

28. |

Add lines 9, 11 and 13 for total tax paid in Canada |

28. |

|

29. |

Adjustments to credit claimed on U.S. 1040: |

|

|

|

29a. |

Canadian portion of credit claimed on U.S. 1040, line 43 |

29a. |

|

29b. |

Canadian income taxed by Michigan from all U.S. 1116 forms |

29b. |

|

29c. |

Gross Canadian income from all U.S. 1116 forms |

29c. |

|

29d. |

Divide line 29b by line 29c and enter percentage |

29d. |

|

29e. |

Multiply line 29a by line 29d for adjusted |

|

|

|

amount claimed on U.S. 1040 |

29e. |

30.Subtract line 29e from line 28 for amount available for credit on

31.Canadian provincial tax from line 11. Enter here and on form

32.Credit for tax paid Canadian province (lesser of lines 27, 30 or 31). Enter here and on form

27.

%

30.

31.

32.

ATTACH THIS FORM TO YOUR

Document Specs

| Fact Name | Details |

|---|---|

| Form Title | Michigan Department of Treasury, ITD 777 |

| Previous Designation | Formerly known as C-4402 RC |

| Purpose | To claim a resident credit for tax imposed by a Canadian province |

| Governing Law | Issued under Public Act 281 of 1967 |

| Filing Status | Filing is voluntary for taxpayers |

| Tax Year Reference | Applicable for the tax year specified on the form |

Fill out Common Templates

2022 Michigan Tax Forms - Comprehensive form to be filled by Grand Traverse Resort and Casinos patrons, allowing for the generation of personal win/loss statements for Player’s Club Card members only.

For anyone seeking guidance on the transfer process, our resource includes a detailed overview of the essential Motor Vehicle Bill of Sale documentation required in Maryland. You can access the necessary form by visiting the comprehensive Motor Vehicle Bill of Sale requirements.

Michigan Form 163 - Provisions are made for the attachment of a detailed legal description or an exhibit if the space provided is insufficient.