Free Michigan C 8000H Template in PDF

The Michigan C 8000H form plays a crucial role in the state's tax system, specifically in determining the apportionment of the Single Business Tax. This form, issued under the authority of Public Act 228 of 1975, is designed for businesses operating in multiple states, helping them allocate their income and tax liability fairly among jurisdictions. It consists of several key sections that guide taxpayers through the computation of their apportionment percentage based on property, payroll, and sales factors. For instance, the form requires businesses to assess the average value of their Michigan property and payroll, as well as their total sales within the state. Each factor is weighted differently, with property and payroll contributing 10% each, while sales carry a significant weight of 80%. Additionally, the C 8000H includes specific instructions for businesses that may qualify for a special formula, as well as a section dedicated to capital acquisition apportionment, applicable to certain recaptures. Understanding this form is essential for compliance and accurate tax reporting in Michigan.

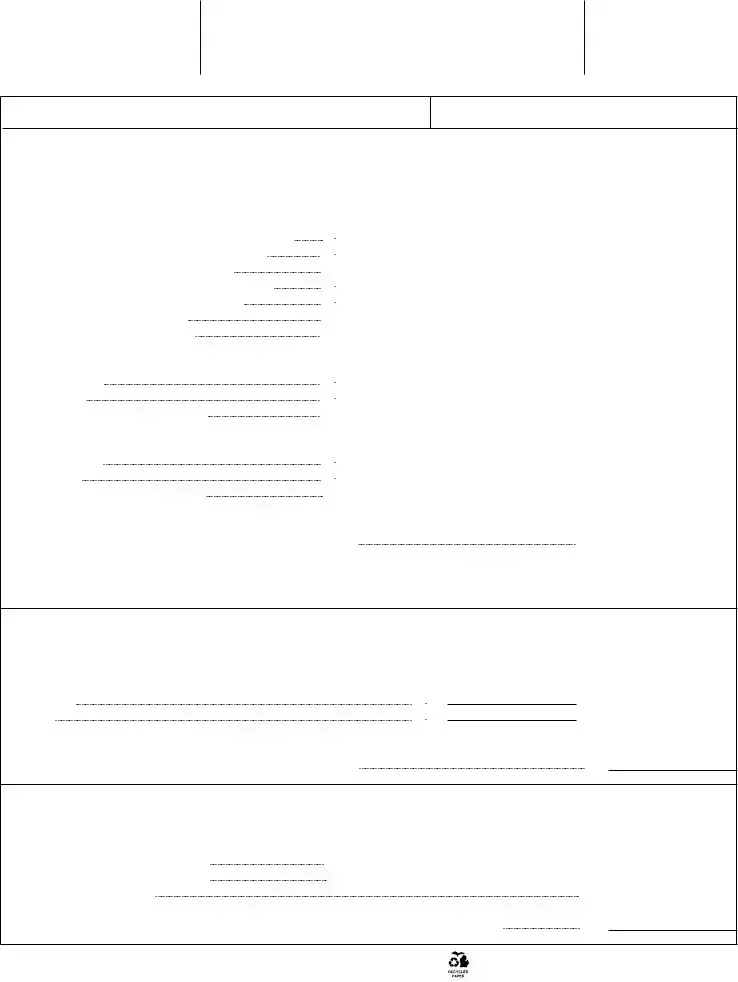

Form Example

Michigan Department of Treasury (Rev.

SINGLE BUSINESS TAX APPORTIONMENT FORMULA

This form is issued under authority of P.A. 228 of 1975.

See instruction booklet for filing guidelines.

1998

1 Name

2 Federal Employer ID No. (FEIN) or TR No.

PART 1 COMPUTATION OF APPORTIONMENT PERCENTAGE

If 100% of your property and payroll is attributable |

|

|

|

|

A |

|

B |

|

C |

|

to Michigan, you must include documentation to |

|

|

|

|

|

|

||||

substantiate nexus with another state. |

|

|

|

|

|

|

Weighting |

|

Weighted |

|

|

|

|

|

|

|

|

|

|

||

|

PROPERTY FACTOR* |

|

|

|

|

|

|

Factors |

|

Percentage |

|

|

|

|

|

|

|

|

|

|

|

3 |

Average value of Michigan property held during the year |

▼ |

3 |

|

|

|

.00 |

|

|

|

4 |

Multiply Michigan rentals by 8 and enter the result |

▼ |

4 |

|

|

|

.00 |

|

|

|

5 |

Total Michigan property. Add lines 3 and 4 |

|

5 |

|

|

|

.00 |

|

|

|

6 |

Average value of total property held during the year |

▼ |

6 |

|

|

|

.00 |

|

|

|

7 |

Multiply total rentals by 8 and enter the result |

▼ |

7 |

|

|

|

.00 |

|

|

|

8 |

Total property. Add lines 6 and 7 |

|

8 |

|

|

|

.00 |

|

|

|

9 |

Percentage. Divide line 5 by line 8 |

|

9 |

|

|

|

% |

x 10% |

9 |

% |

|

PAYROLL FACTOR |

|

|

|

|

|

|

|

|

|

10 |

Michigan wages |

▼ |

10 |

|

|

|

.00 |

|

|

|

11 |

Total wages |

▼ |

11 |

|

|

|

.00 |

|

|

|

12 |

Percentage. Divide line 10 by line 11 |

|

12 |

|

|

|

% |

x 10% |

12 |

% |

|

SALES FACTOR |

|

|

|

|

|

|

|

|

|

13 |

Michigan sales |

▼ |

13 |

|

|

|

.00 |

|

|

|

14 |

Total sales |

▼ |

14 |

|

|

|

.00 |

|

|

|

15 |

Percentage. Divide line 13 by line 14 |

|

15 |

|

|

|

% |

x 80% |

15 |

% |

16 |

Apportionment percentage. Add column C, lines 9, 12 & 15**. |

|

|

|

|

|

|

|

|

|

|

Use this percentage to apportion your tax base on |

|

|

|

|

|||||

|

and to apportion the capital acquisition deduction on |

|

|

16 |

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

*The Commissioner of Revenue may require periodic averaging of property values during the tax year if this is reasonably required to reflect the average value of the filer's property.

**If you do not have three factors (if line 8, 11 or 14 is zero) see Formulas for Special Situations on page 35 of the instructions.

PART 2 TRANSPORTATION SERVICES, FINANCIAL ORGANIZATIONS, OR

TAXPAYERS AUTHORIZED TO USE A SPECIAL FORMULA, USE THE LINES PROVIDED BELOW.

(Attach explanation. )

17 Michigan

▼

17

.00

18Total

19Apportionment percentage. Divide line 17 by line 18.

Use this percentage to apportion your tax base on

▼

18

.00

19 |

% |

|

PART 3 CAPITAL ACQUISITION APPORTIONMENT

This part is only used for certain recaptures. Complete this part only if you disposed of depreciable personal property that you acquired in tax years beginning before Oct. 1, 1989.

20 |

Property factor (from line 9, column A) |

20 |

% |

|

|

|

21 |

Payroll factor (from line 12, column A) |

21 |

% |

|

|

|

22 |

Total. Add lines 20 and 21 |

|

|

|

22 |

% |

23 |

Average percentage. Divide line 22 by 2; if you have only one factor enter the amount from line 22. |

|

|

|||

|

Use this percentage to compute your recapture of capital acquisition deduction on |

23 |

% |

|||

www.treasury.state.mi.us

Document Specs

| Fact Name | Details |

|---|---|

| Form Purpose | The Michigan C 8000H form is used to calculate the apportionment percentage for the Single Business Tax. |

| Governing Law | This form is issued under the authority of Public Act 228 of 1975. |

| Filing Guidelines | Instructions for completing the form can be found in the accompanying instruction booklet. |

| Property Factor | The property factor includes the average value of Michigan property and rentals, weighted to reflect their significance. |

| Payroll Factor | This factor is calculated based on Michigan wages compared to total wages, helping determine the tax responsibility. |

| Sales Factor | Sales made in Michigan are compared to total sales, with a significant weight assigned to this factor (80%). |

| Apportionment Calculation | To find the overall apportionment percentage, add the results of the property, payroll, and sales factors together. |

| Special Situations | If any of the three factors (property, payroll, or sales) are zero, alternative formulas must be consulted as outlined in the instructions. |

| Capital Acquisition | Part 3 of the form is specifically for recapturing capital acquisition deductions for certain disposals of property. |

Fill out Common Templates

What Is a Life Scan - Enforces compliance with the Federal Privacy Act, ensuring that applicants' personal information and fingerprints are handled with the utmost care.

Michigan Retirement Tax - Offering an option to credit overpayments to future tax liabilities or request refunds provides flexibility in managing finances.

Completing a Medical Power of Attorney form is crucial for ensuring your healthcare preferences are respected, especially in situations where you may be incapacitated. This document empowers a trusted individual to make vital medical decisions on your behalf, thus providing peace of mind during challenging times.

Uia 1772 - Employers are encouraged to check a box if they wish to request the UIA 1772 form for further processing of business discontinuance or disposition.