Free Michigan Cts 02 Template in PDF

The Michigan CTS-02 form serves as a critical tool for charitable organizations seeking to renew their solicitation registration under the Charitable Organizations and Solicitations Act (COSA). This form is primarily intended for organizations whose previous registration has expired or is nearing expiration. It requires organizations to provide updated information, including any changes to their organizing documents, bylaws, or charitable purposes since their last submission. Importantly, the renewal process must be initiated 30 days prior to the expiration of the registration, as the registration itself expires seven months after the close of the organization’s fiscal year. Organizations are encouraged to utilize their assigned file number for all correspondence to ensure efficient processing. While there is no fee associated with the renewal, specific details such as the designation of a Michigan resident agent and the reporting of professional fundraisers must be meticulously completed to avoid delays. By adhering to the guidelines outlined in the CTS-02 form, organizations can maintain compliance and continue their vital work in the community.

Form Example

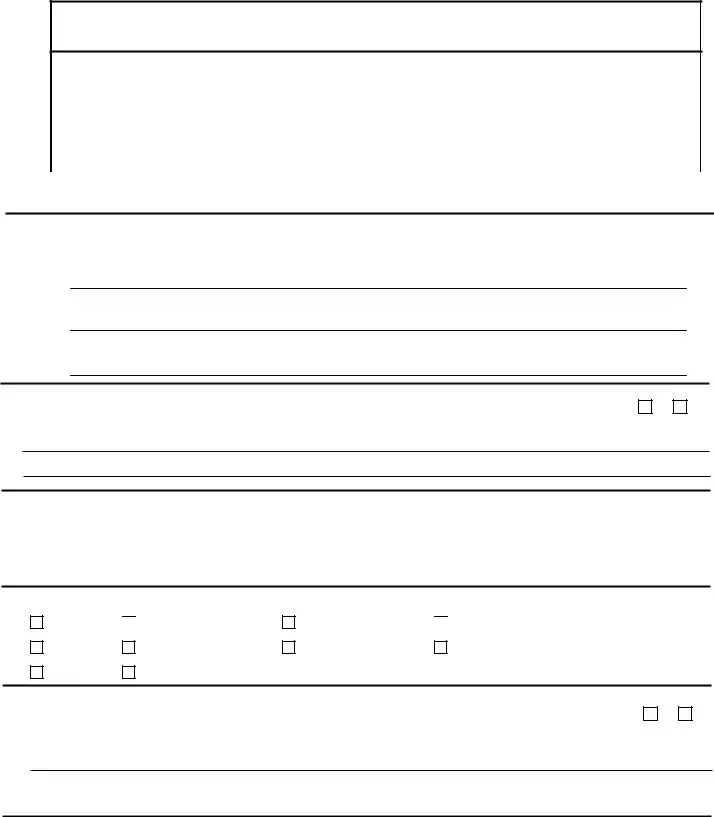

CTS - 02

AUTHORITY: MCL 400.271 et seq.

PENALTY: civil, criminal

State of Michigan Department of Attorney General

RENEWAL SOLICITATION FORM

Charitable Organizations and Solicitations Act (COSA)

Who should file this form?

Charitable organizations:

•Renewing their solicitation registration;

•Whose prior solicitation registration has expired. If your registration has expired, provide copies of any changes to your organizing documents, bylaws, IRS status, or charitable purposes since your previous submission.

Who should not file this form?

•Charitable organizations filing for the first time to solicit in Michigan. Instead, use Form CTS- 01;

•Organizations exempt from registration. See Form

INSTRUCTIONS

GENERAL INFORMATION

Extensions – Your solicitation registration will expire 7 months after the close of your fiscal year (financial accounting period). Your renewal form is due 30 days before the expiration of your registration. If you need an extension of time to file the Renewal Solicitation Form, it must be requested in writing before your registration expires. Your registration expiration date will be extended for 5 additional months.

Use of file number – The organization has been assigned a file number that must be used on correspondence and forms sent to this office. Your file number will be printed on the registration.

Fees – There is currently no fee to register to solicit in Michigan.

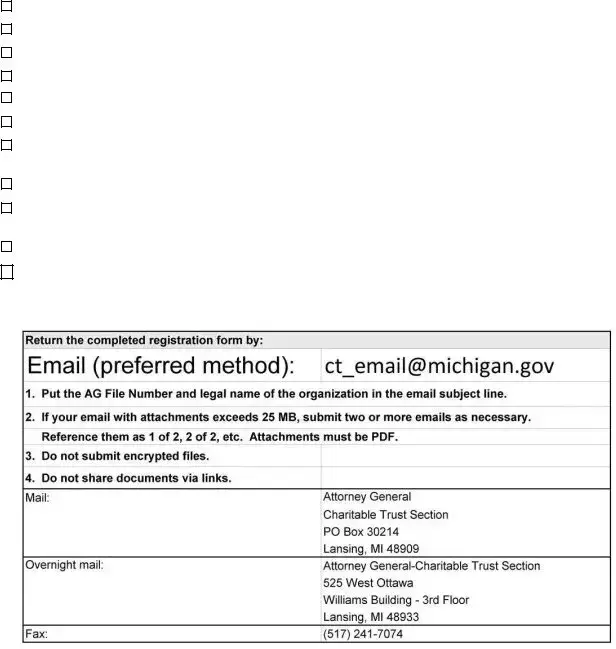

Filing the renewal form – You may renew your registration by email, efiling, fax, or by mail. For

faster processing, use email or efiling.

Email - Put the AG file number and legal name in the email subject line. The Form and

all required documents should be attached in PDF form.

Efile – On the Attorney General’s website, http://www.michigan.gov/agcharity, scroll down to the link for How to

Mail - Send the Renewal Solicitation Form to:

Department of Attorney General Charitable Trust Section

PO Box 30214 Lansing, MI 48909

Telephone: (517)

Fax: (517)

Email: ct_email@michigan.gov

For additional information, visit our website at www.michigan.gov/agcharity.

Verify that we have received your filing

Search for the organization at www.michigan.gov/AGCharitySearch. The search results will state, “Application/registration pending.”

SPECIFIC INSTRUCTIONS

To avoid delays and unnecessary correspondence, answer all questions completely.

Name – Enter the organization's exact legal name on the renewal form. This will be the same name as is currently on the articles of incorporation or other organizing document. If you use any names other than the legal name, enter each name on the solicitation form in the space All other names under which you intend to solicit.

Item 2. If your charitable purposes or activities have changed since submitting your last registration form, summarize in 50 words or less the organization's current charitable purposes. This summary will be added to our database and our searchable website. Do not simply quote or refer to the articles of incorporation or provide the standard IRS 501(c)(3) language.

Item 3. A Michigan resident agent must be named for the acceptance of process issued by any court. The renewal form will not be processed without this information. You must provide a street address, not a P.O. box. The organization cannot name itself, the Michigan Attorney General, or the

1

Michigan Secretary of State as its resident agent. You may designate a private individual residing in Michigan. If you need information on companies that will act as resident agent for a fee, you may wish to do your own internet research. Our office does not provide lists of such companies.

Item 9. The engagement and compensation of all professional fundraisers providing services on Michigan campaigns must be reported in the

schedule.

A professional fundraiser (PFR) is anyone who “plans, conducts, manages, or carries on a drive or

campaign of soliciting contributions for or on behalf of a charitable organization.” A consultant that only has consulting contracts does not have to be licensed as a professional fundraiser. Y ou do not have to report consulting contracts. E mployees of

a charitable organization are PFRs if they are

paid wholly or in part by commissions – including bonuses – based on funds raised.

If you are unsure if the services provided by a person or firm you contracted with are such that a PFR license is required, provide a copy of the contract with your renewal form and request to have the contract reviewed. You will be notified if you must complete Part II and if the contractor should be licensed as a PFR.

Verification of license of PFR - Michigan law requires that you verify that any PFR with which you contract for fundraising in Michigan is currently licensed with this office.

PFR Contract - You are required to provide copies of contracts with PFRs within 10 days of signing a new contract or extending an existing contract.

Campaign Financial Statement -

Campaign Financial Statements, Form

PFR Chart on Renewal Form-

Sum of all payments to / retained by PFR during the year reported – Include all fees, reimbursements, or other payments to the PFR that were related to the campaign or activity conducted by the PFR for the organization. Any monies that were retained by the professional fundraiser before remitting the proceeds of a campaign or activity to the charity must also be

included here. If the PFR listed was engaged after the close of the fiscal year reported in Item 10, enter "N/A" in this column.

Consultants - To qualify as a consultant, all of the following conditions must be met:

•the PFR is usually retained by a charitable or religious organization for a fixed fee or rate that is not computed on the basis of funds raised or to be raised;

•the PFR does not solicit funds, assets or property, but only plans, advises, consults, or prepares materials for a solicitation or fundraising event in Michigan;

•the PFR does not receive or control funds, assets, or property solicited in Michigan; and

•the PFR does not employ, procure, or engage any compensated person to solicit, receive, or control funds, assets, or property.

Item 10. An organization registering to solicit must provide a financial statement for its most recently completed fiscal year. If an organization files Form 990,

The IRS return must be prepared in accordance with IRS instructions. If you do not follow the instructions, we may question the return even if the IRS does not. All applicable schedules and attachments required by the IRS form or instructions must be submitted. However, if you file Form 990 or

Organizations that file Form

Item 11. - Briefly describe the organization's activities or accomplishments during the fiscal period. Provide a sheet if additional space is needed. Do not simply restate the organization's charitable purpose.

Item 12. – Complete all lines. You must enter the end date of the accounting period. Do not leave any lines blank. Enter "0" if applicable.

On line D, enter all costs related to conducting the charitable activities and accomplishments discussed in Item 11.

2

Item 13. Audited or reviewed financial statements requirement - If audited financial statements have been prepared for the year being reported, provide a copy with the renewal form. It is not necessary to complete the schedule.

For all others, complete the schedule to calculate if audited or reviewed financial statements will be required. Total support may be reduced by the amount of governmental grants received during the year.

Audited financial statements must be prepared in accordance with generally accepted accounting principles.

If audited or reviewed financial statements are required, but they have not been prepared:

•You may request a

•If the required financial statements are in the process of being prepared or you have already engaged an auditor to perform the necessary review or audit, provide a letter requesting a conditional registration. In your letter, state when you expect the financial statements to be available. Also, provide a copy of the signed engagement letter agreement with the audit firm. The solicitation registration will

include the condition that the required financial statements are to be provided by a specified date.

•The financial statements requirement may be suspended for food banks and similar organizations whose contributions are substantially

typically converted to cash. Provide your suspension request, with the reason for the request, with the registration form. This must be done each year when applicable.

Item 14. Select YES and provide the information requested on the form if you are a parent organization that directly supervises and controls a local, county, or area division or chapter that is also a separate legal entity.

Unless previously submitted, you MUST provide:

•

appropriate documentation to show that you directly supervise and control the

•chapter;

names and addresses of each chapter to

•be included in your registration; and separate financial statements for each chapter

3

CTS - 02

AUTHORITY 1975 PA 169 PENALTY: civil, criminal

State of Michigan

Department of Attorney General

RENEWAL SOLICITATION FORM

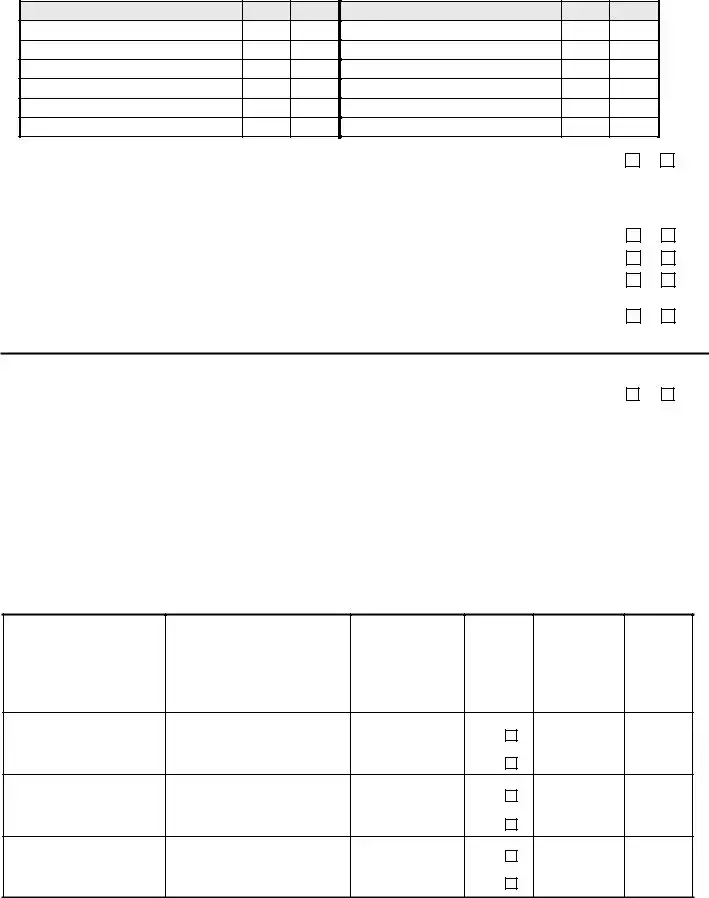

Full legal name of organization

All other names under which you intend to solicit

Attorney General File Number |

Telephone number |

Fax number |

|

|

|

Employer Identification Number (EIN) |

Organization email address |

Organization website |

|

|

|

All items must be answered. Provide additional sheets if necessary. If you have questions, see the instructions.

1.Organization addresses –

A. Street address of principal office. If you do not have a principal office, provide the name and address of the person having custody of the financial records.

B.Organization mailing address, if different.

C.Provide the address of all other offices in Michigan.

Yes No

2. Has there been any change in the organization's purposes? . . . . . . . . . . . . .

If yes, summarize organization's current purposes below in 50 words or less. This summary appears on our website.

3. You must designate a resident agent located in Michigan authorized to receive official mail sent to your organization.

Name ___________________________________________________________________________________________

Address (Michigan street address, not PO box) _______________________________________________________________

4. Methods of solicitation. Check all that apply.

Telephone

Internet

Personal contact

Personal contact

Radio / television

Special events

Newspaper/magazines

Other (specify) ____________________________

Other (specify) ____________________________

None (explain) ____________________________

Yes No

5. Has there been a change in the organization's tax status with the IRS since your last filing? . . . .

If yes, explain and document.

4

6. List all current officers and directors unless they are included on your IRS return. Mark the box to indicate whether the person is an officer, director, or both. Provide an additional sheet if necessary.

Name

Officer Director

Name

Officer

Director

|

|

|

|

Yes |

No |

7. |

Is there any officer or director who cannot be reached at the organization’s mailing address? . . . . |

|

|

||

|

If “yes,” provide the names and addresses on an additional sheet. |

|

|

|

|

|

|

|

|

||

8. |

Since your last registration form, has the organization or any of its officers, directors, employees or fundraisers: |

Yes |

No |

||

|

A. Been enjoined or otherwise prohibited by a government agency/court from soliciting? |

|

|

||

|

B. Had its solicitation registration or license denied or revoked by any jurisdiction? |

. . . . . . . . |

|

|

|

|

C. Been the subject of a proceeding regarding any license, registration, or solicitation? |

|

|

||

|

D. Entered into a voluntary agreement of compliance with a government agency or in a case |

|

|

||

|

before a court or administrative agency? |

. . . . . . . . . . . . . . . . . . . . |

|

|

|

If any "yes" box is checked, provide a complete explanation on a separate sheet.

Has the organization engaged a professional fundraiser (PFR) for Michigan

9. fundraising activity for either the financial accounting period reported in item 10 or the current period? See instructions for definition of "professional fundraiser."

A consultant is not a PFR.

Yes No

If no, go to question10.

If yes, in the chart below list all PFRs that your organization has engaged for Michigan fundraising activity. Provide additional sheets if necessary. Provide copies of contracts for each PFR listed if not already provided.

Note – You are required to verify that all PFRs under contract for Michigan campaigns are currently licensed.

Professional Fundraisers Under Contract for Michigan Campaigns

|

|

|

Is contract |

|

|

|

|

in effect |

|

|

|

Sum of all payments |

now (as you |

If no, enter |

|

|

|

||

|

|

to / retained by PFR |

complete |

date contract |

Name |

Mailing address |

during year reported |

the form)? |

ended |

|

|

|

|

|

End date:

y n

End date:

y n

End date:

y n

5

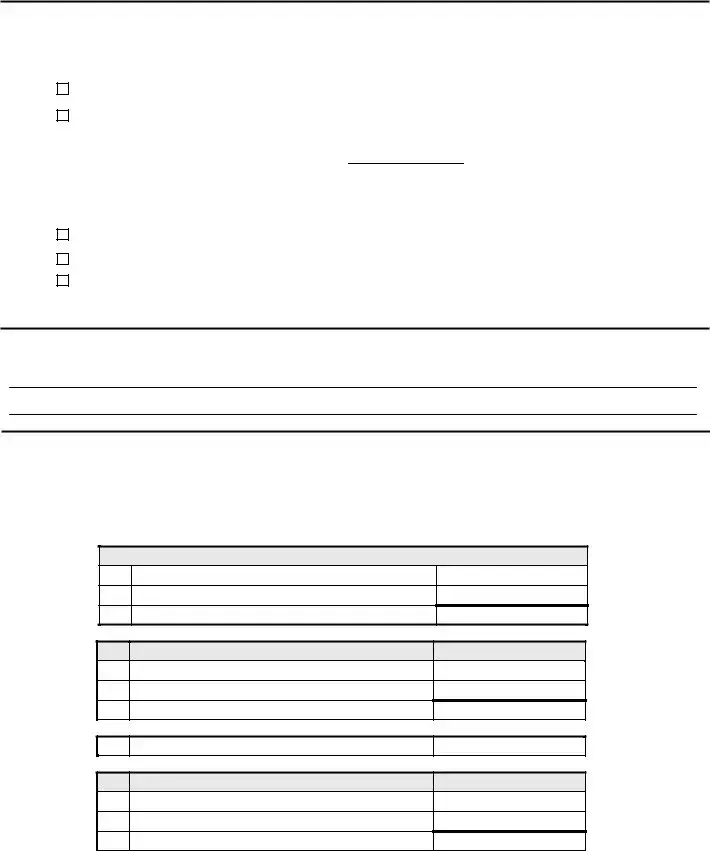

10. All organizations must report on their most recently completed financial accounting period.

Check the box to indicate the type of return filed with the IRS and follow the instructions:

Form 990 or

Form

Total program services expense: $

If your organization does not file the above returns with the IRS, check the appropriate box below to explain the reason, and follow the instructions:

Files Form

Included in IRS group return. Provide a copy of the group return. Complete 11 and 12 below.

Other reason. Explain: _______________________________________________________________

Complete 11 and 12 below.

11.Briefly describe your charitable accomplishments during the period. ____________________________________

12.Complete this section only if directed to in item 10 because your organization does not complete a Form 990,

Enter the end date of the financial accounting period reported below: |

____/_____/_____ |

REVENUE

AContributions and fundraising received B All other revenue

C Total revenue (add lines A and B)

Expenses

DCharitable program services expense

EAll remaining expenses (supporting services) F Total expense (Sum of lines D and E)

G Revenue less expenses (subtract line F from line C)

Balance Sheet

HTotal assets at end of fiscal period I Liabilities at end of fiscal period

J Net assets (subtract line I from line H)

6

13. Audited or reviewed financial statements requirement

Complete the following schedule to determine if audited or reviewed financial statements are required. If audited or reviewed financial statements are required, but they have not been prepared, see the instructions.

|

Item |

Where to Find it: |

Amount |

|

|

Form 990: Part VIII, line 1h; |

|

A. |

Contributions from IRS return |

Form |

|

|

|

Form |

|

|

|

|

|

B. |

Net income from special fundraising |

Form 990: Part VIII, line 8c; |

|

events |

Form |

|

|

C. |

Net income from gaming activities |

Form 990: Part VIII, line 9c |

|

D. |

Total contributions and fundraising |

Add lines A, B, and C |

|

|

|

|

|

|

|

|

|

E. |

Governmental grants |

Form 990: Part VIII, line 1e; |

|

Form |

|

||

|

|

|

|

|

|

grants included above on line A. |

|

|

|

|

|

F. |

|

Subtract line E from line D |

|

|

|

|

After completing the schedule:

•If line F is $550,000 or more, audited financial statements are required. They must be audited by an independent certified public accountant and prepared in accordance with generally accepted accounting principles.

•If line F is greater than $300,000, but not greater than $550,000, financial statements either reviewed or audited by a certified public accountant are required.

Yes No

14. Do you have chapters in Michigan that are to be included in the solicitation registration?

Tip: If you have offices in Michigan with no separate reporting or filing requirements, answer “no.”

If yes, provide the following:

•a listing of the names and addresses of all Michigan chapters to be included

•a financial report for each chapter (see instructions)

•a copy of your organization's IRS group return (if applicable)

Note – if you have chapters but have not previously informed us of your intent to include them, see the instructions.

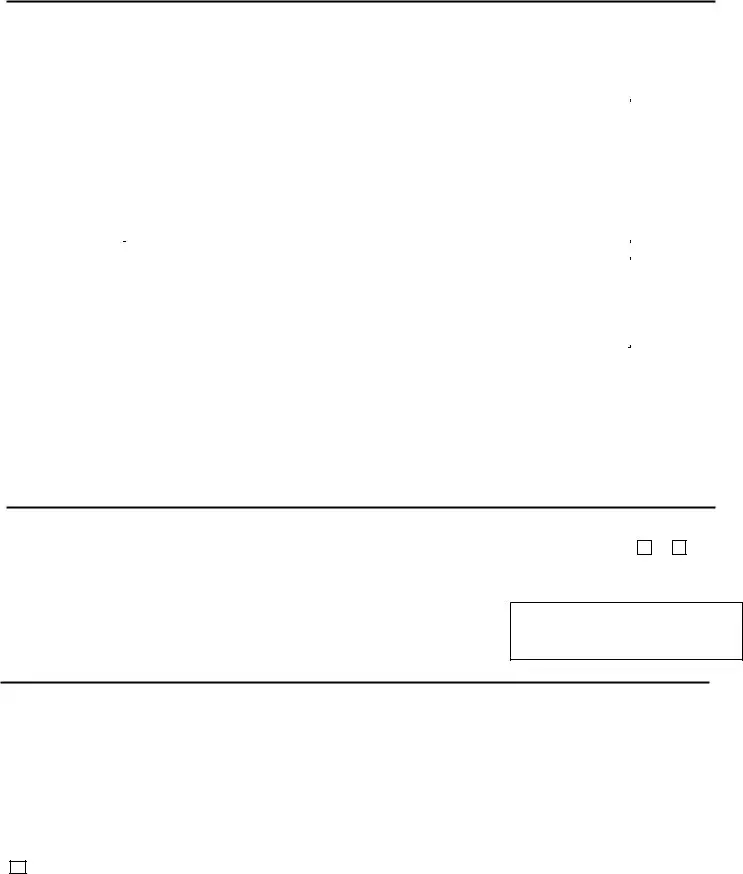

15. I certify that I am an authorized representative of the organization and that to the best of my knowledge and belief the information provided, including all accompanying documents, is true, correct, and complete. False statements are prohibited by MCL 400.288(1)(u) and MCL 400.293(2)(c) and are punishable by civil and criminal penalties.

Type or print name (must be legible): |

________________________________________________________ |

||

Title: |

|

|

Date: ______________________ |

Check here if you would like to request an automatic

THIS IS A PUBLIC RECORD, COPIES OF WHICH ARE SENT, UPON REQUEST, TO ANY INTERESTED PERSON.

7

CHECKLIST:

Have all parts of the form been fully completed unless instructed otherwise?

Have you provided the name and Michigan street address of a resident agent in item 3? Is a list of the officers and directors provided or included with the IRS return?

Have you provided a complete IRS 990,

If you file Form

If you file Form

If audited or reviewed financial statements are required, are they provided? If not, have you requested a conditional registration or

Are the Form 990 and financial statements prepared for the same reporting period?

Have you submitted contracts and addenda to contracts with professional fundraisers that have not been previously submitted?

Have you typed or printed your name, date, and title in Item 15 to certify the form?

If you are requesting a

Revised |

8 |

2/20/2020

Document Specs

| Fact Name | Details |

|---|---|

| Governing Law | This form is governed by the Charitable Organizations and Solicitations Act (COSA), MCL 400.271 et seq. |

| Who Should File | Charitable organizations renewing their solicitation registration or those whose prior registration has expired. |

| Registration Expiration | Solicitation registration expires 7 months after the close of the fiscal year. |

| Extension Request | A written request for an extension must be made before the registration expires; this grants an additional 5 months. |

| File Number Usage | Organizations must use their assigned file number on all correspondence and forms. |

| Filing Methods | The renewal form can be filed via email, e-filing, fax, or mail, with email being the fastest option. |

| Financial Statement Requirement | Organizations must provide a financial statement for the most recently completed fiscal year with the renewal form. |

| Professional Fundraiser Reporting | Organizations must report all engagements with professional fundraisers and verify their licenses. |

Fill out Common Templates

Michigan Credit for Taxes Paid to Another State - Detailed instructions for Michigan residents working across the border in Canada.

For anyone considering their healthcare preferences, understanding the nuances of a critical Medical Power of Attorney document is vital. This form grants a trusted individual the authority to make medical decisions on your behalf when you are unable to communicate your wishes effectively.

State of Michigan 2022 Tax Forms - Audit compliance is affirmed by providing an address where operational records can be examined, underscoring the regulatory aspect of the application.

Michigan 4568 - The form includes sections for various credits, including Compensation and Investment Tax Credits, to reduce tax liabilities.