Free Michigan L 4258 Template in PDF

The Michigan L 4258 form, officially known as the Real Estate Transfer Tax Valuation Affidavit, plays a crucial role in real estate transactions within the state. This form is specifically required when the purchase price of a property is not explicitly stated on the deed. It serves to provide necessary valuation details to the Michigan Department of Treasury, ensuring compliance with local tax regulations. The form must be filled out and signed by the seller or their authorized agent, which adds a layer of accountability to the process. Key components of the L 4258 include information about the property, such as its county and city or township, as well as the names and addresses of both the seller and purchaser. Additionally, it requires details on the type of document being executed, whether a deed or land contract, and the associated financial figures, including cash payments and mortgage amounts. If the consideration for the property is less than its market value, the form prompts the user to disclose that market value. Ultimately, the L 4258 ensures that all relevant financial considerations are documented, providing transparency and facilitating the proper calculation of state and county taxes. The seller's signature and notarization complete the process, affirming the accuracy of the information provided.

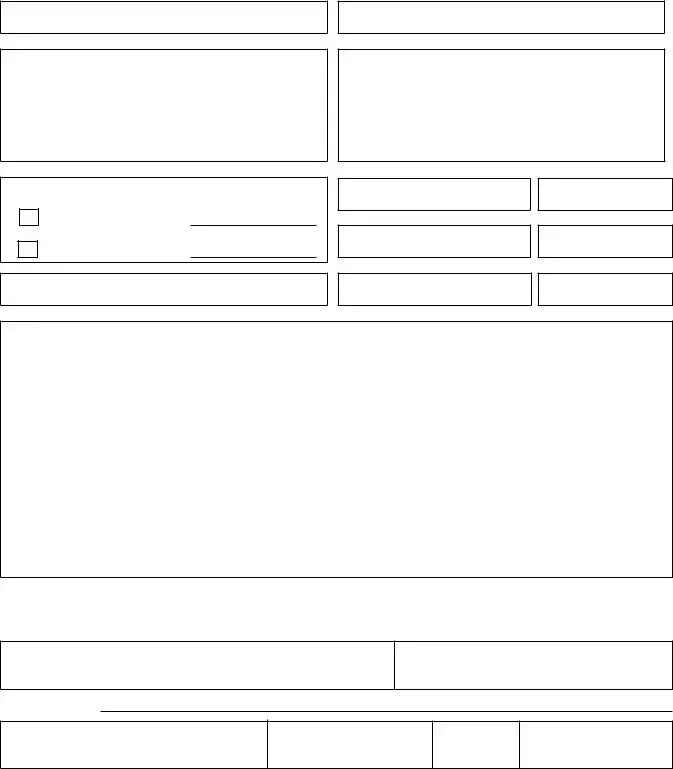

Form Example

Michigan Department of Treasury

REAL ESTATE TRANSFER TAX VALUATION AFFIDAVIT

This form is issued under authority of P.A. 134 of 1966 and 330 of 1993 as amended.

This form must be filed when you choose not to enter the amount paid for real estate on the deed. It is not necessary when the amount paid is entered on the deed. This form must be completed and signed by either the seller or his/her authorized agent.

1. County of Property

3. Seller's Name and Mailing Address

2. City or Township of Property

4. Purchaser's Name and Mailing Address

5. Type and Date of Document

Land Contract |

Date: |

DeedDate:

10. If consideration is less than market value, state market value.

6. Cash Payment

$

8. Amount of Mortgage/Land Contract

$

11. Total Consideration (Add lines 6&8)

7.Amount of County Tax

9.Amount of State Tax

12. Total Revenue Stamps

13. Legal Description of Real Estate Transferred

I certify that the information above is true and complete to the best of my knowledge.

Seller's Signature

If signer is other than the seller, print name and title.

NOTARIZATION

Subscribed and sworn to me:

Notary Public

State of Michigan; County of:

on this date

My commission expires on:

Document Specs

| Fact Name | Description |

|---|---|

| Governing Laws | This form is issued under the authority of Public Act 134 of 1966 and Public Act 330 of 1993, as amended. |

| Purpose | The L-4258 form is required when the amount paid for real estate is not included on the deed. |

| Filing Requirement | It is not necessary to file this form if the purchase amount is already stated on the deed. |

| Who Completes the Form | The form must be completed and signed by either the seller or an authorized agent of the seller. |

| Information Required | Key details include the county and city or township of the property, names and addresses of the seller and purchaser, and financial details like cash payment and mortgage amount. |

| Notarization | The form requires notarization, confirming that the information provided is true and complete to the best of the signer's knowledge. |

Fill out Common Templates

New Employee Forms Michigan - Advises on the periodic review of procedures and policies related to new hire reporting to ensure ongoing compliance with changes in the law.

Michigan Disabled Veteran Benefits - Document to affirm the permanent and total disability of a veteran for property tax exemption purposes.

For those involved in the eviction process, it is important to utilize available resources to ensure compliance with legal procedures, such as the Illinois PDF Forms, which provide essential templates and guidance for completing the Illinois Notice to Quit form accurately and effectively.

Michigan Tax Return Form - Form 2248 allows your business to securely pay its taxes online through EFT debit.