Free Michigan Pc 584 Template in PDF

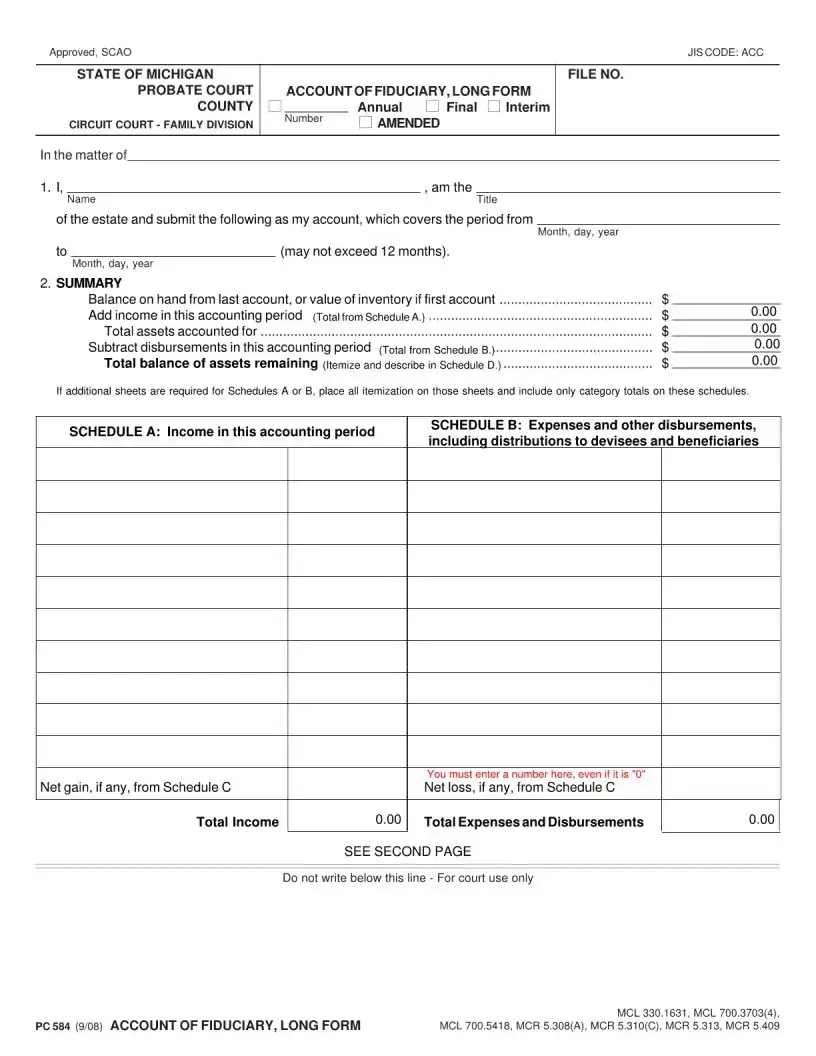

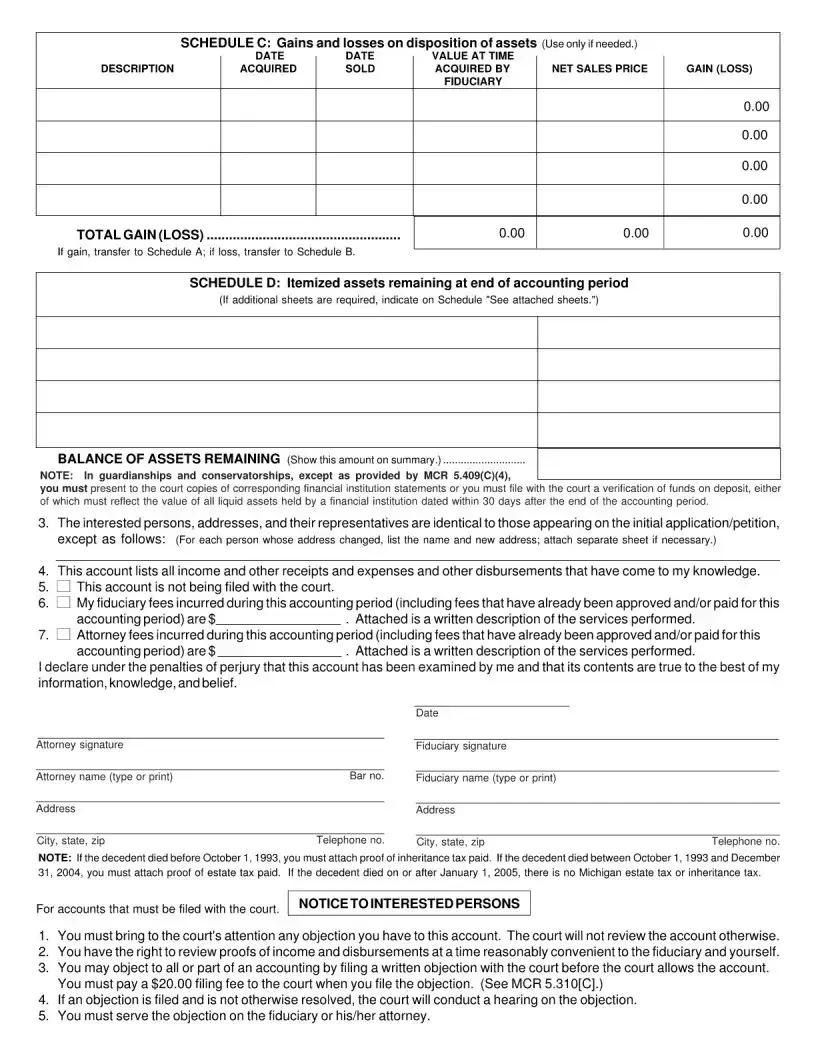

The Michigan PC 584 form, known as the Account of Fiduciary, Long Form, plays a crucial role in the probate process by providing a detailed accounting of a fiduciary's management of an estate. This form is used primarily by personal representatives, guardians, or conservators to report financial activities related to the estate over a specified period, which cannot exceed twelve months. It includes a summary section where fiduciaries must report the balance on hand, total income received during the accounting period, and any disbursements made. Detailed schedules accompany the summary, allowing for itemization of income, expenses, and any gains or losses from the disposition of assets. Additionally, fiduciaries are required to provide information about their fees and any attorney fees incurred during the accounting period. The form also emphasizes the importance of transparency, as it mandates the disclosure of interested persons and their representatives, ensuring that all parties are informed of the financial status of the estate. Notably, if the fiduciary does not file this account with the court, it must still be prepared accurately to maintain accountability. The PC 584 form thus serves as a vital tool for maintaining trust and clarity in the management of estates in Michigan.

Form Example

Document Specs

| Fact Name | Description |

|---|---|

| Form Title | The form is titled "Account of Fiduciary, Long Form" and is designated as PC 584. |

| Governing Laws | This form is governed by several Michigan laws, including MCL 330.1631, MCL 700.3703(4), and MCL 700.5418. |

| Purpose | The form is used to provide an accounting of a fiduciary's management of an estate over a specified period. |

| Submission Frequency | The form can be submitted as an annual, final, or interim accounting. |

| Income Reporting | Fiduciaries must report all income received during the accounting period in Schedule A. |

| Disbursement Reporting | Schedule B requires detailed reporting of all expenses and disbursements made during the accounting period. |

| Verification Requirement | For guardianships and conservatorships, financial institution statements or verification of funds must be provided to the court. |

| Objection Process | Interested persons can file a written objection to the account with the court, subject to a $20 filing fee. |

Fill out Common Templates

Unconditional Release - The inclusion of a completion date and contact particulars solidifies the agreement, marking the end of the contractual obligations.

To ensure your healthcare decisions are respected, consider utilizing a highly beneficial Medical Power of Attorney document, which can be found at the following link: vital Medical Power of Attorney paperwork. This form not only confirms your healthcare preferences but also empowers your chosen representative to advocate for your wishes when you are unable to do so yourself.

Michigan Tax Return - Refunds may be requested for overpayments, vehicle sales, death of vehicle owner, suspended driver’s license, or dual vehicle registration.