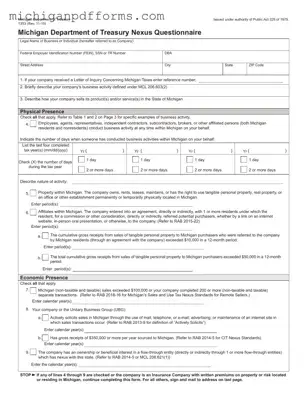

The Michigan 1353 form is a Nexus Questionnaire issued by the Michigan Department of Treasury, designed to gather information about a business's presence and activities within the state. This form plays a critical role in determining whether a company has...

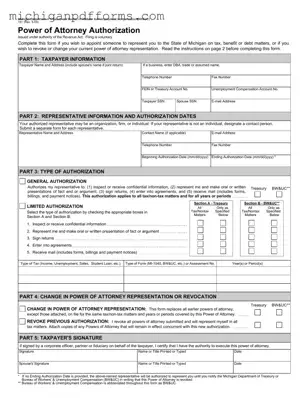

The Michigan 151 form serves as a Power of Attorney Authorization, allowing individuals to appoint a representative for tax, benefit, or debt matters before the State of Michigan. This form is voluntary and can also be used to revoke or...

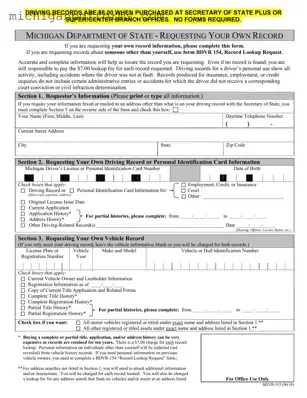

The Michigan 153 form is a document used to request personal driving records from the Michigan Department of State. It is essential for individuals seeking to obtain their own driving history, including information on accidents and other driving-related activities. Understanding...

The Michigan 165 form, officially known as the 2021 Sales, Use, and Withholding Taxes Annual Return, serves as a comprehensive document for businesses to report their tax obligations in the state of Michigan. This form consolidates various tax types, including...

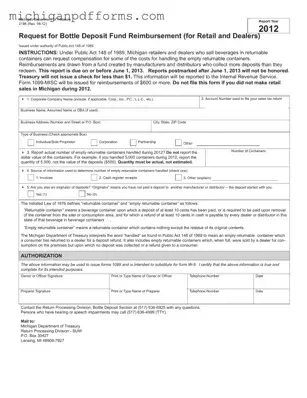

The Michigan 2196 form is a request for reimbursement from the Bottle Deposit Fund, designed for retailers and dealers who sell beverages in returnable containers. Under the authority of Public Act 148 of 1989, this form allows businesses to seek...

The Michigan Department of Treasury Form 2248 is an Electronic Funds Transfer (EFT) Debit Application that allows taxpayers to notify the state of their intention to pay taxes electronically. Filing this form is mandatory for those wishing to use the...

The Michigan Department of Treasury 2271 form, also known as the Concessionaire's Sales Tax Return and Payment, is a mandatory document for vendors operating in Michigan. This form facilitates the collection and remittance of sales, use, and income tax withholding...

The Michigan 2368 form is an affidavit used to claim a Principal Residence Exemption (PRE) for property tax purposes. This form must be filed with the local assessor of the city or township where the property is located. By submitting...

The Michigan 2766 form, also known as the Property Transfer Affidavit, is a document required by the Michigan Department of Treasury for reporting the transfer of real estate and certain types of personal property. This form must be filed within...

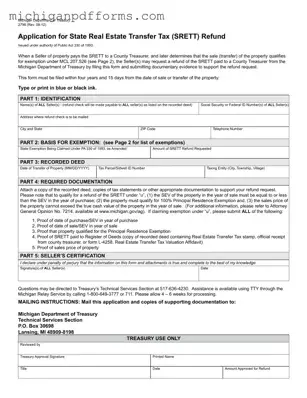

The Michigan Department of Treasury 2796 form is an application used to request a refund for the State Real Estate Transfer Tax (SRETT) paid during a property sale. Sellers who discover that their transaction qualifies for an exemption under state...

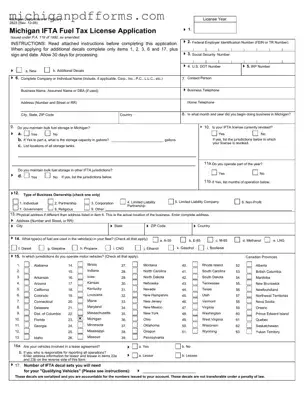

The Michigan Department of Treasury 2823 form is the application for the International Fuel Tax Agreement (IFTA) Fuel Tax License. This form is essential for motor carriers operating qualified vehicles in Michigan and at least one other IFTA jurisdiction. Completing...

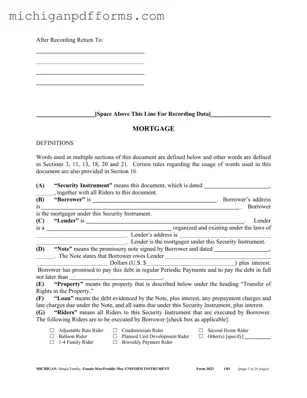

The Michigan 3023 form is a legal document used in mortgage transactions within the state of Michigan. It serves as a security instrument that outlines the rights and obligations of both the borrower and lender in a real estate transaction....