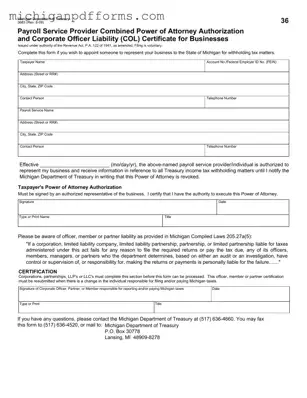

The Michigan 3683 form is a document issued by the Michigan Department of Treasury that allows businesses to appoint a payroll service provider or individual to represent them in withholding tax matters. By completing this form, businesses can ensure that...

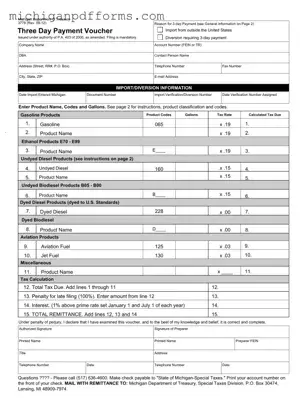

The Michigan Department of Treasury 3778 form is a mandatory document used for reporting and paying taxes on imported or diverted motor fuel within three business days. This form is essential for individuals and companies who import fuel from outside...

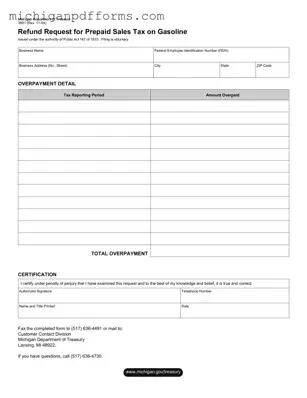

The Michigan Department of Treasury 3891 form serves as a Refund Request for Prepaid Sales Tax on Gasoline, allowing businesses to reclaim overpaid taxes. This form is issued under the authority of Public Act 167 of 1933, and its filing...

The Michigan 3924 form, also known as the Withholding Tax Schedule, is a document required by the Michigan Department of Treasury for individuals who had state income tax withheld during the tax year. This form allows taxpayers to report the...

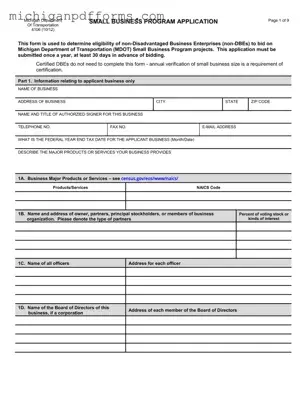

The Michigan 4106 form is an application used by non-Disadvantaged Business Enterprises (non-DBEs) to determine their eligibility to participate in the Michigan Department of Transportation's Small Business Program. This form must be submitted annually, at least 30 days before bidding...

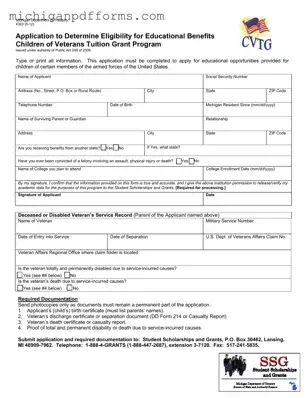

The Michigan Department of Treasury 4363 form is an application used to determine eligibility for educational benefits under the Children of Veterans Tuition Grant Program. This program, established by Public Act 248 of 2005, provides educational opportunities for children of...

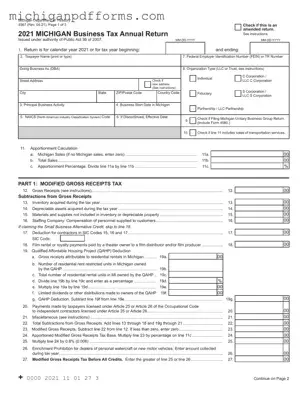

The Michigan Department of Treasury Form 4567 is the annual return for the Michigan Business Tax (MBT), designed to calculate both the Modified Gross Receipts Tax and the Business Income Tax for standard taxpayers. This form is essential for businesses...

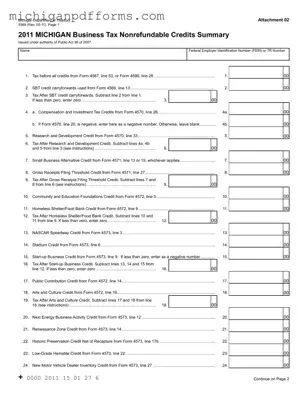

The Michigan Department of Treasury Form 4568 serves as a summary for nonrefundable credits under the Michigan Business Tax (MBT). This form is essential for determining a taxpayer's liability after applying various credits, ensuring that eligible taxpayers can accurately report...

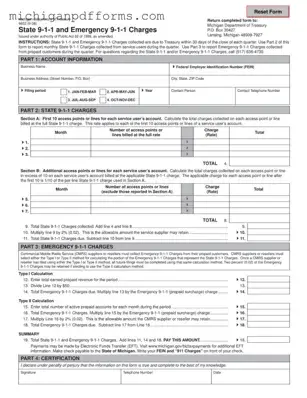

The Michigan 4652 form is a document used to report State 9-1-1 and Emergency 9-1-1 Charges, as mandated by Public Act 32 of 1986. This form is essential for service providers to accurately report charges collected from customers and ensure...

The Michigan 4816 form is a document used to request billing from the Department of Treasury for sellers following a Principal Residence Exemption (PRE) denial. This form is crucial for counties or local treasurers to ensure that the correct taxes,...

The Michigan 5092 form is a tax return used to amend previously filed monthly or quarterly sales, use, and withholding tax returns. This form allows businesses to correct errors or update information related to their tax obligations for a specific...

The Michigan 5107 form is an official document used to apply for a property tax exemption specifically designed for disabled veterans and their unremarried surviving spouses. This form, issued under Public Act 161 of 2013, allows eligible individuals to claim...